Just how Was Tx USDA Finance Computed?

Tx USDA Finance is actually calculated based on projected money calculated because of the lenders on the up coming 1 year. The maximum loan amount formula is carried out considering every readily available historic analysis, and it also is sold with the current shell out stubs together with W2s. But not, the new USDA has lay their earnings restrict, and it is computed just before write-offs are made of the fresh payroll. Gross income is actually an expression of any bonuses, paycheck, tips, payment, overtime, and also provider compensation; additionally, it may is life allowances pricing or perhaps the homes allotment obtained.

If you live within a family group where a member try an effective farmer otherwise they’ve a business, there is certainly today the effective use of net gain off surgery. Simultaneously, loan providers likewise have their unique specific advice and this revolve up to a career and income.

The funds try subject to underwriting otherwise individual recognition. Other restrictions will get pertain. This is simply not a deal out of borrowing or a connection to help you provide. Guidelines and you may goods are susceptible to changes.

The new USDA Loan Recognition Processes to have good USDA loan from inside the Colorado begins with contacting an approved USDA Financing Personal Financial. Approved USDA Financing Personal Lenders was backed by the usa Agency from Farming but do not in fact give you your house financing by themselves.

Exactly what are the Benefits of A colorado USDA Loan?

The main benefit of a texas USDA Financing is getting secured towards the a 30-season mortgage having the lowest fixed interest and potentially no advance payment specifications. Without having a downpayment, you will personal loans in Prince have to shell out a premium to possess financial insurance coverage in order to mitigate the new lender’s risk.

Texas USDA financing advantages and disadvantages

Next, no cash reserves are necessary. It will help you get property reduced without a great deal of cash secured on bank.

The financing and you will being qualified direction try flexible, which also makes it much simpler so you’re able to be eligible for investment, regardless if your credit history, declaration, and you may ratings was given that top because they want feel getting antique otherwise industrial capital.

Other brighten of the system is that it can be lay right up and so the merchant pays this new closing costs. The lack of prepayment punishment and reduced repaired rates of interest try a couple of alot more enjoys you to save a little money. You could use this financing to invest in settlement costs and you can repairs straight into the mortgage.

The general autonomy of program is really so flexible which you may use this 1 for strengthening a home, to shop for a house, if not just refinancing you to. The application assists Agricultural Manufacturers with Doing work Loans to simply help fund Farming Surgery. This type of Working Fund give recommendations to own producers to gain access to quality locations.

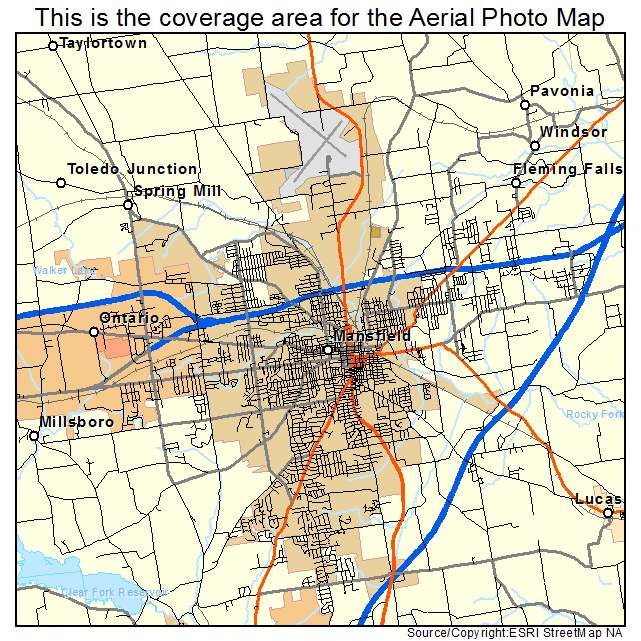

For starters, there are geographical restrictions. Even though many Texans qualify into the system, its oriented way more on rural and you can suburban homes, very men and women residing highly towns may well not qualify. The good news is, you’ll find online learning resources where you are able to merely plug on street address of every property to choose almost certainly eligibility.

Subsequently, discover money restrictions. For individuals who or your family can make excess amount in excess of your own system caps, you might not be eligible for recommendations otherwise masters.

3rd, financial insurance policy is constantly included in the loan. Meanwhile, its good to get that exposure, and genuinely required to start by. But not, pushed introduction for the mortgage you are going to stop you from looking around for your own personal insurer of preference.

Last ultimately, that it loan and program you should never qualify for duplex homes. Appropriate homes can simply become unmarried-family unit members products. And, they must be owner-filled, you cannot make use of these benefits to have flips, rentals, otherwise travel home.

Comment closed!