It’s possible to have fun with funds from your own 401(k) to invest in a house, however, if you ought to hinges on several things, including taxation and you may punishment, how much you have currently saved as well as your book financial points.

In this article:

- 401(k) Withdrawal Guidelines

- The way you use The 401(k) to order a property

- Any time you Make use of 401(k) to get a home?

- Solution A means to Buy a house

If the coupons to own a new household is short of your own mission, you may be considering playing with money from your own 401(k), particularly when it holds enough money to meet up with the latest advance payment for your fantasy domestic.

But can you remove money from their 401(k) to invest in another domestic? Yes, you can utilize a great 401(k) buying a house, however, whether you really need to utilizes extent you may have conserved, possible punishment for early withdrawal plus financial predicament.

401(k) Detachment Rules

Although many 401(k) preparations allows you to fool around with 401(k) fund given that property down payment, doing so could lead to tax effects. That’s because withdrawing money happens contrary to the main purpose out-of a beneficial 401(k): saving to own old-age. The latest Irs actually incentivizes one to kepted sufficient currency to have old age by offering tax advantages for one another traditional and you will Roth 401(k) contributions:

- Antique 401(k): Your contributions are built pre-income tax, and therefore cuts back your taxable money, if you are withdrawals inside retirement is taxed given that typical money.

- Roth 401(k): Your benefits are made which have after-taxation money and you can build tax-100 % free. Roth 401(k) withdrawals produced during retirement also are tax-100 % free.

The Irs allows you to build penalty-100 % free withdrawals from the later years accounts when you arrive at years 59?. Which have pair conditions, to make withdrawals ahead of age 59? usually topic you to definitely a great 10% very early detachment penalty. As well, withdrawals out-of a vintage 401(k) is actually taxed since the typical income, but that is not true with Roth 401(k) withdrawals because your efforts is actually taxed initial.

If preserving up adequate having a deposit are an obstacle to buying a house, making use of your own 401(k) is certainly one substitute for make it easier to reach your mission. Each approach has its own advantages and you can downsides to look at.

step one. Score a 401(k) Loan

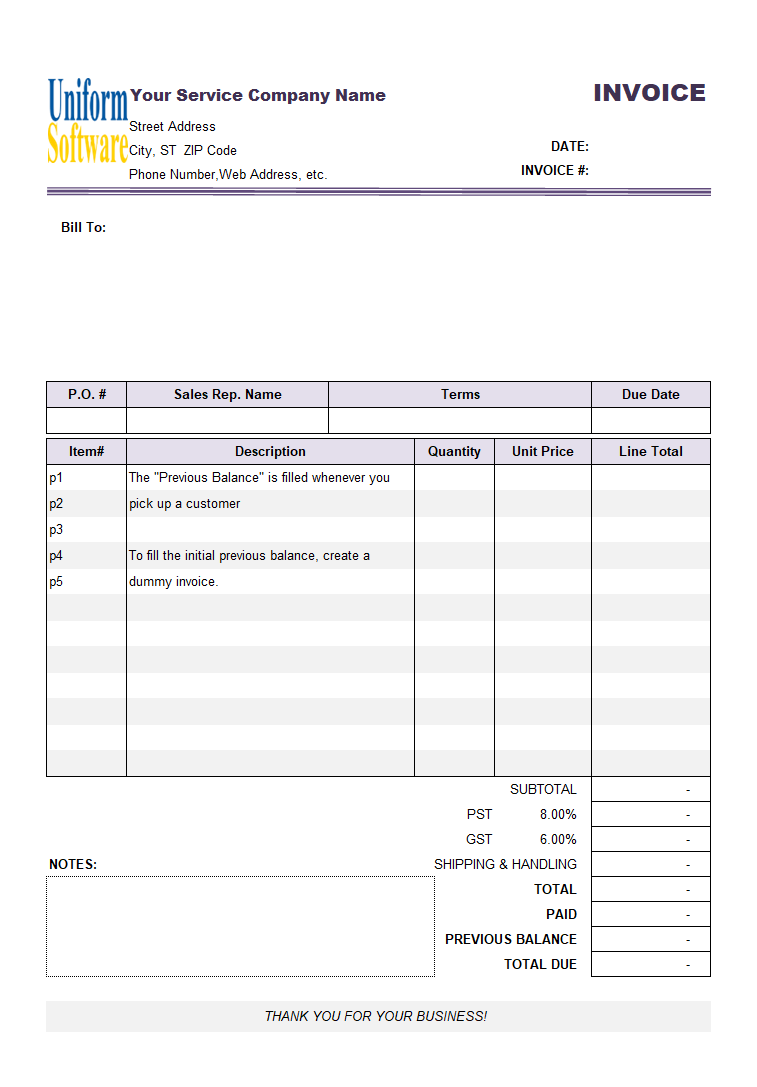

/cloudfront-us-east-1.images.arcpublishing.com/gray/QLPJS3NAIVBEFBLAF77QCQCQ5I.jpg)

- It permits one to prevent the 10% early detachment taxation penalty. Due to the fact you are fundamentally loaning currency to help you on your own, you shouldn’t sustain people taxation punishment, and also the borrowed count will not be taxed because the regular income.

- It does not grounds into your personal debt-to-income ratio (DTI).DTI is the number of your own complete month-to-month debt burden opposed along with your overall gross monthly income. Extremely lenders pick good DTI ratio of below 43% so you’re able to be eligible for a home loan, though some choose actually straight down DTI ratios lower than thirty-six%. People debt your debt their 401(k) package immediately after that loan won’t be set in it calculation.

- It won’t connect with your credit rating. Your credit score does not come into play with 401(k) fund. There is no need a credit rating to help you be eligible for a 401(k) loan, therefore the mortgage will receive zero results on the mortgage acceptance possibility.

Later years preparations vary by the company, although extremely you could use from your 401(k) are $50,000 or 50 % of the vested equilibrium if it’s lower than $100,000. Certain preparations bring a different and permit one acquire up so you’re able to $ten,000 regardless of if your vested equilibrium is leaner than just it number.

Essentially prepaid debit card cash advance, 401(k) fund should be paid off within this 5 years during the an interest rate place by the 401(k) bundle manager, constantly a small number of commission factors higher than the modern primary price. Remember, you’re effortlessly paying your self back that have attention. But when you leave your task ahead of you paid off the loan, the newest loan’s due date speeds up to another location income tax filing due date.

Comment closed!