Now that you have reviewed a guide to home collateral finance and you may mortgages, let us diving actually better and you can discuss the trick differences between these types of two well-known loan alternatives:

Distinction #1: Uses

Possibly the biggest difference in property equity loan and an effective home mortgage relates to employing the borrowed funds. A mortgage is used to help you initial purchase a property otherwise refinance a home. Additionally, a property equity mortgage is employed once you have purchased an excellent the place to find safety the cost of do-it-yourself renovations, performing a corporate, time for college, an such like.

Huge difference #2: Qualifications

Various other difference between a property collateral financing and you can an interest rate refers to qualifications. If you are both domestic security financing and mortgage loans believe facts such as credit history, earnings, and you will loans-to-income proportion (DTI) whenever choosing qualifications, family guarantee finance require also which you have no less than 20% guarantee on your established where you can find be considered.

Improvement #3: Brand new Loan’s Rates of interest

Home collateral loans and you will mortgages are available with various desire rates. Though house equity fund usually come with lower cost than the other types of personal loans, this type of rates of interest are still constantly greater than those people that come having mortgages.

At the same time, just remember that , rates of interest are different for all financing products considering your credit score, location, loan identity, and other circumstances.

Differences #4: Loan Terms and conditions

The loan term is another difference in family guarantee financing and mortgage loans. Really mortgages, eg old-fashioned financing, feature expanded terms of 30 years, regardless of if 15-seasons words are also available.

Rather, household collateral loans come with reduced terms and conditions that will may include four and you will fifteen years. So it financing sorts of always boasts highest interest rates.

Differences #5: Taxation Deductions

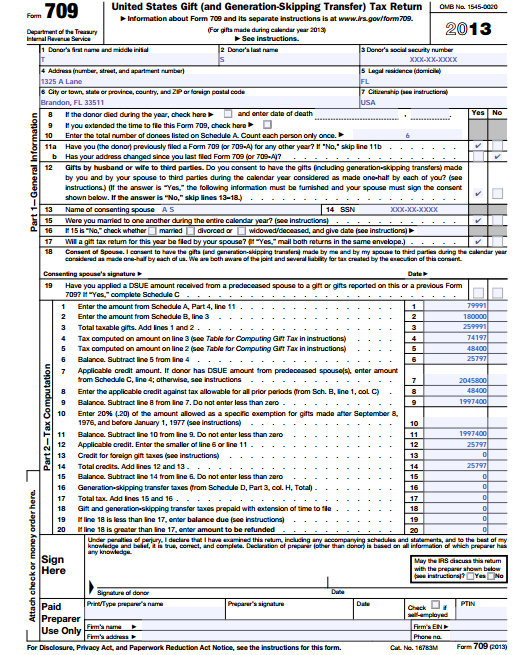

It is critical to envision variations in tax deductions ranging from home guarantee finance and mortgage loans. For many who got out your home loan before , you are able to deduct the interest in your loan amount right up in order to $1 million. For people who grabbed your mortgage just after , you are able to deduct the interest on your mortgage to $750,one hundred thousand.

When you find yourself playing with a house guarantee loan so you can purchase, create, otherwise dramatically enhance the household one to obtains the mortgage, you can easily deduct the attention in your mortgage up to $750,100. Previously, you’re capable deduct the attention in your financing no number how currency was utilized. New signal applies to household collateral loans of 2018 to help you 2025.

Which are the Positives and negatives of a property Collateral Financing?

- Flexibility to use the money as you want to further your own financial requirements such as for instance to invest in an investment property, remodeling your residence to create collateral, or starting a business.

- Fixed rates lead to repaired repayments and versatile terms one to start around four in order to fifteen years.

- Seemingly lower rates compared to other kinds of loans you to you’d normally use to financing assets, knowledge, companies, etcetera.

- Your home is put as guarantee for your home guarantee financing, so you’re putting your house on the line if you aren’t ready and then make your loan repayments.

- You’ll be with essentially a few mortgage repayments as household collateral finance are labeled as 2nd mortgages.

- You will shell out more within the desire with a home equity mortgage compared to the a house collateral personal line of credit while the you might be credit a lump sum payment.

Do you know the Positives and negatives off a mortgage?

- Makes it possible to initially safer a home, after which you can following make security and eventually bring in an income otherwise make use of guarantee with other aim.

Comment closed!