That have a predetermined-Speed Home Security Loan off Palisades Borrowing Union, you could tap into the home collateral you spent some time working so hard in order to accrue. You will also delight in the ease of developing repaired monthly installments. When you currently have a large expenses planned, a home Equity Mortgage is generally a much better option than just a great Domestic Equity Personal line of credit. Use just what you would like and you can repay the mortgage for the an excellent budget-amicable schedule regarding predictable monthly premiums. Have another thing in mind? That’s good, too.

Getting a more when you look at the-depth research out-of house guarantee fund and personal lines of credit, see the Difference in property Security Mortgage compared to.

- Fixed Speed along the longevity of the borrowed funds.

- Re-finance present Mortgage loans / Household Security Funds.

- Set up account hobby announcements compliment of On the internet Banking.

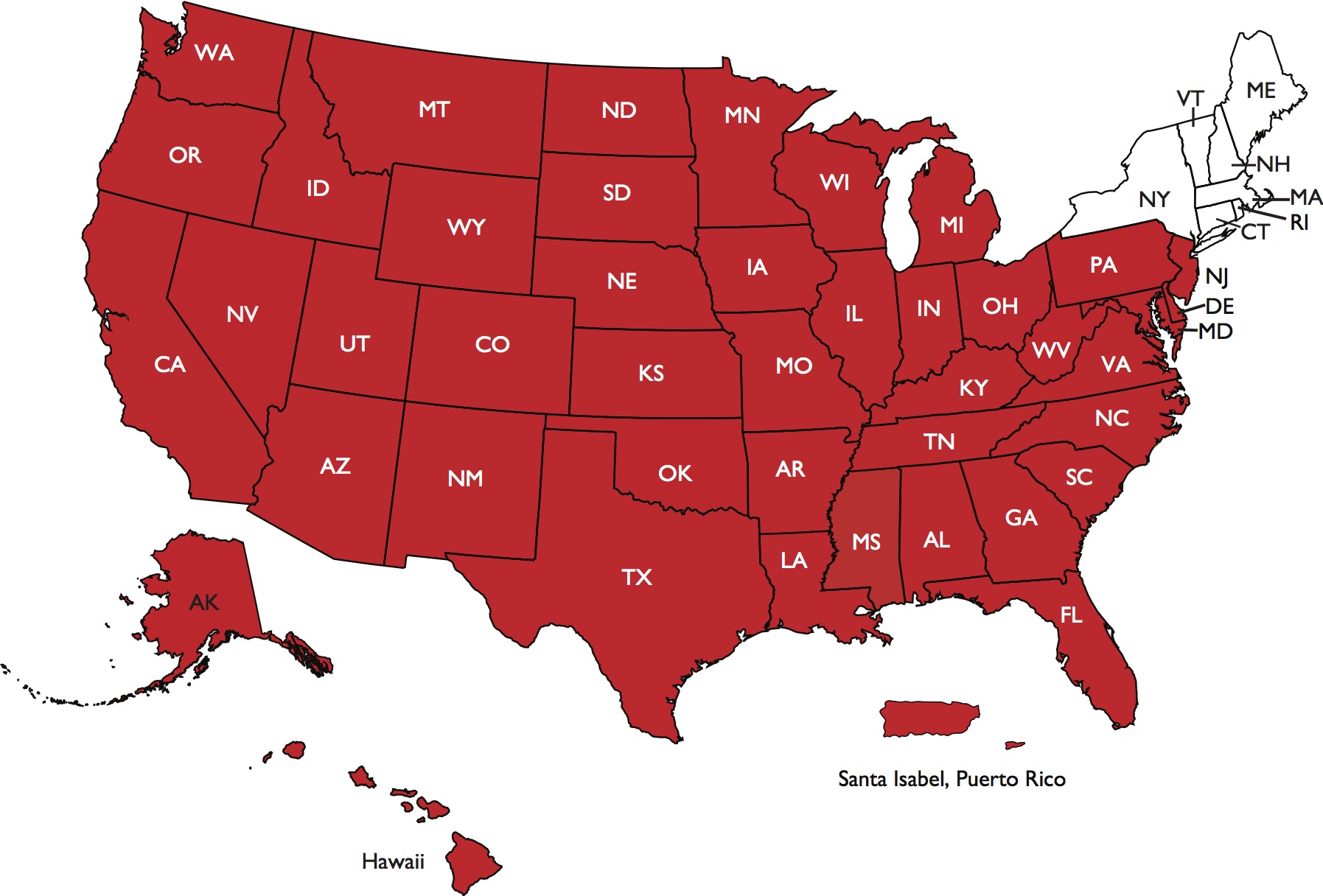

- On functions during the Ny, New jersey, Connecticut, Massachusetts, and you can Pennsylvania.

- You are able to income tax advantages. Consult your income tax mentor to choose eligibility.

You might consider your house collateral loan due to the fact an additional mortgage. The application form process would be the same as their experience obtaining exclusive financial. There may even be settlement costs, a fixed loan title, repaired interest, and you can foreseeable monthly premiums. They are number one parallels between a mortgage and you may a great family equity financing.

A property Collateral Personal line of credit

Your own full family guarantee are calculated by deducting the majority of your home loan harmony about current property value your property (since the calculated as a result of an appraisal). Basically, it’s possible so you’re able to acquire a certain part of their overall offered collateral. Its advisable that you get off the it untouched so that you dont find yourself “underwater” (after you are obligated to pay significantly more on the domestic as opposed currently worth). Good Palisades Borrowing from the bank Commitment Mortgage Officer makes it possible to gauge the restrict count you may be in a position to obtain.

Palisades Borrowing Relationship was a no further-for-money, member-owned lender one to is available entirely to meet up the latest financial need your players. From online membership starting so you can Automatic teller machine-percentage refunds, no monthly solution fee, and money-straight back rewards, we have been proud to carry your among the best credit connection Domestic Guarantee Finance to possess Bergen State, Rockland Condition, and select communities inside the New york.

In the Palisades Borrowing Union, our purpose should be to generate cherished relationship as a consequence of a longevity of economic possibilities. With well over $two hundred million inside the possessions and most fourteen,one hundred thousand people, i consistently make an effort to offer the participants basic-category financial features. Our desire is on our people while the district, allowing us to tailor brand new borrowing products and you will characteristics we offer to your needs regarding Rockland Condition, Nyc; Bergen State, Nj; and select communities in the Nyc.

Our very own Repaired-Rate Household Collateral Financing make it property owners to make use of the readily available collateral to greatly help funds home improvements, pay expenses, consolidate higher attention financial obligation, or perhaps to refinance established high-rate mortgage loans

Prepared to move forward along with your agreements to possess home improvement otherwise debt consolidation reduction? Make an application for a house Equity Financing otherwise one of the other mortgage brokers on the web otherwise see your nearby PCU area in Nanuet, The new Town, or Orangeburg, Ny.

* APR=Apr. Rates active by 9/. Speed was susceptible to alter anytime that’s subject to borrowing from the bank acceptance. Prices are at the mercy of Lender’s borrowing requirements, certain requirements and constraints implement. Repaired regards to up to 180 weeks. Lowest amount borrowed try $twenty-five,one hundred thousand, limit loan amount is actually $five-hundred,one hundred thousand. Household Equity Loans are only found in 2 nd lien condition, and really should end up being secured from the borrower’s no. 1 home and you will is of home-based step one-cuatro tool hold, condominium otherwise Structured Metropolitan Creativity (PUD). Give applies simply to qualities based in Nyc, Nj-new jersey, CT, PA and you may MA. Prices start only 5.75% to have fund within the 2nd updates with mortgage in order to worth proportion up 70%. For financing with mortgage so you’re able to really worth ratio up to one hundred%, costs begin Penrose loans only 7.00%. Borrower may have to spend a closing rates recapture commission if the loan is actually finalized during the very first 3 years of your origination big date. Property insurance coverage requisite. Ton insurance coverage may be required. Predicated on an effective $twenty five,000 financing which have a great 5.75% Annual percentage rate for 60 weeks, monthly obligations could be $480.

Comment closed!