- Thought all of the financing brands: While you are USDA financing are a great choice for particular borrowers, it’s important to know all alternatives, eg Virtual assistant loans otherwise FHA funds.

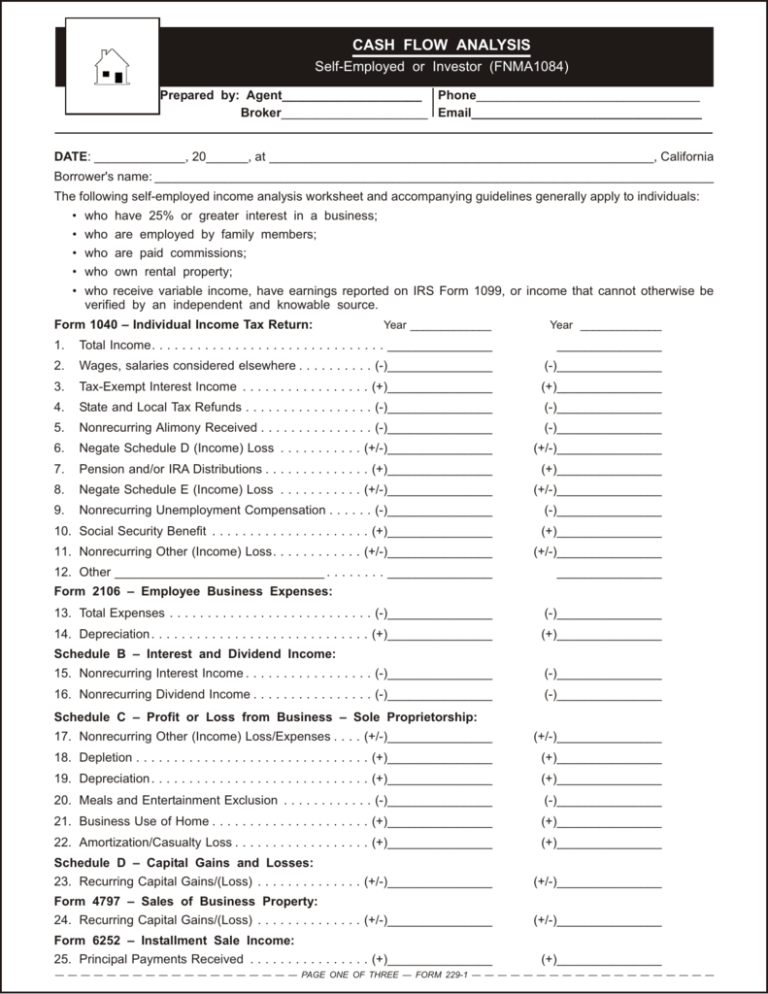

- Assemble data files: When you submit your own USDA application for the loan, you are required to fill in certain records eg pay stubs, tax returns, and you can investment and you will responsibility statements. The application processes is certainly going more smoothly if you’ve gained such documents beforehand.

Making an application for a USDA Mortgage

USDA fund has actually book qualifications and you may approval criteria, and it is important to know how to apply for that securely. Why don’t we comment for each and every trick step of techniques.

Get a hold of good USDA Financial

To acquire an effective USDA mortgage, you must manage a prescription bank. Really lenders list on their websites if they bring USDA money. The fresh new Company out of Farming as well as preserves a listing of loan providers you to definitely currently promote these types of funds. If you reside in the an outlying area and you may understand others who have tried USDA fund, a term-of-lips testimonial would-be good first rung on the ladder in order to slim your list of prospective lenders.

Get Pre-Approved to own good USDA Mortgage

Pre-recognition is a vital step-in to shop for a home when it comes down to particular home loan. Loan providers test your money and discover whether you are qualified to receive a good mortgage, as well as the amount borrowed and interest you may also qualify for. Pre-recognition can also make providers expected to deal with the provide.

See an excellent USDA-Accepted Household

To obtain an effective USDA loan, our home you might be to find must satisfy the needs. Earliest, our home must be situated in an eligible outlying area. You are able to brand new chart provided with the fresh Company out-of Agriculture to track down eligible parts close by.

Residential property financed with an effective USDA loan need certainly to meet specific high quality requirements. With respect to the USDA, your house must be decent, safer, and you will hygienic. Like other funds, USDA money need an appraisal so that the price are suitable, considering the home’s worthy of.

A buy agreement was a contract ranging from a home’s visitors and you may vendor discussing the brand new terms of the acquisition. Before the USDA bank can start the borrowed funds approval techniques, you’ll need to go into a purchase arrangement with a provider and provide all the details to the financial. The lender will demand information regarding the house plus the consented-abreast of cost.

Initiate the latest Underwriting Procedure

Financial underwriting is the method in which a lender studies your economic pointers to be sure you might be eligible for that loan. Its needed for all the mortgage programs, and to own USDA funds. Into the underwriting techniques, your own financial often guarantee factual statements about your a job, money, and you will credit history to choose your own probably ability to repay.

The loan lender also guarantee details about the house. Very first, you will have to experience an appraisal to determine the home’s worth. In addition, to own good USDA financing, the financial institution will even make sure the home is within the an eligible rural area and matches brand new Agencies regarding Agriculture’s possessions standards.

Their lender could possibly get request you to promote facts regarding underwriting process. The greater number of receptive youre plus the easier you might supply the questioned recommendations, more quickly the loan might possibly be approved.

When your USDA bank have accomplished the brand new underwriting procedure, you’re getting your final acceptance and will also be eliminated to shut in your house.

Brand new closure is the latest step in the house-to get procedure. Its whenever owning a home was directed in the vendor on the consumer. It’s also when you sign one last USDA mortgage https://paydayloancolorado.net/rangely/ files.

From the closing on your loan, you happen to be getting into a contractual contract with your lender, promising to settle this new lent number.

Comment closed!