With a house collateral financing, you could potentially americash loans Guntersville safer a fairly low interest rate to the money need to have renovations otherwise sudden expenses.

Yet not, interest rates try active, and so they can vary higher or down until your secure when you look at the a rate. Newest interest levels count on for each and every novel bank, debtor, and the housing marketplace. Being able lenders estimate home equity loan rates may help influence local plumber to help you protected on the speed.

- Domestic equity funds allows you to acquire regarding the difference between your own mortgage harmony as well as your home’s market well worth in this constraints place of the a lender.

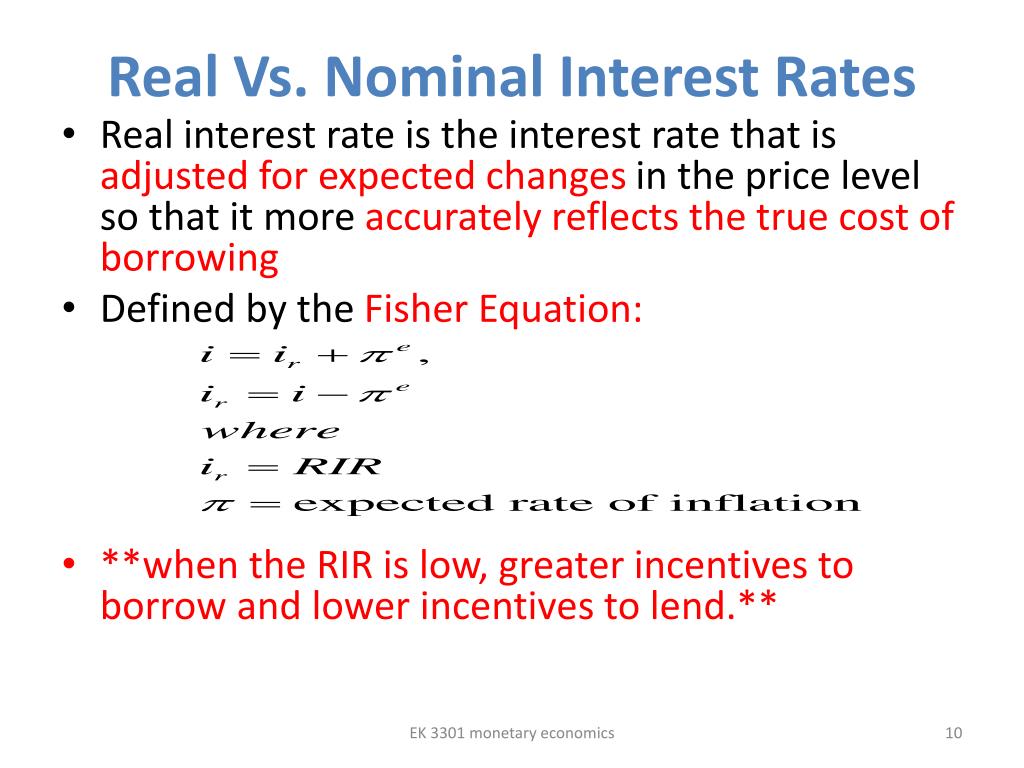

- Home collateral financing cost are different through the years, depending on points including the Government Reserve and you may monetary trends.

- The borrowing and you may earnings along with affect the home collateral loan costs lenders may offer your.

- House collateral finance come with a predetermined price, while you are family guarantee personal lines of credit (HELOCs) typically feature a changeable price.

For each bank, collector, and you will lender put rates of interest centered on their own primary rate – the rate that extremely creditworthy consumers located. Primary costs depend on this new federal fund rates, that your Federal Set aside establishes in order to influence financial fashion as needed.

Brand new Government Put aside generally speaking escalates the federal money speed in reaction so you’re able to rising prices, very interest rates on the house equity funds commonly rise while the inflation do. Monitoring markets styles will save you on your home collateral price.

Credit establishments cure primary costs because the a baseline to own building individual interest levels. Debt history and you may credit rating generally speaking figure the last attention price loan providers provide you with.

Domestic equity mortgage versus. home security credit line (HELOC)

When the a home collateral financing cannot seem like a good fit, you may also make use of their house’s well worth due to family equity credit lines (HELOCs). Such as home security financing, HELOCs allows you to use predicated on your house security, along with your house since guarantee. not, certain important aspects place all of them aside. HELOCs offer rotating borrowing, to withdraw regarding HELOC as required throughout a beneficial lay detachment period in lieu of borrowing from the bank that lump sum.

Interest levels including works differently between them type of finance. House security finance have fixed rates of interest, definition their monthly payments are still the same regarding the cost period. HELOCs keeps variable rates, so you may owe also time than envisioned.

Advantages and disadvantages regarding home security fund

Family security money render alot more stability than HELOCs. Besides create interest rates are nevertheless an identical over the years, however, very carry out monthly payments. This way, you could potentially utilize costs in the monthly finances. Brand new guarantee have interest rates relatively reasonable. House security financing restrict mortgage numbers surpass of numerous handmade cards or personal loans, leading them to an easily affordable selection for of several residents.

There’s particular inflexibility so you can house equity fund that lead for some drawbacks. You can simply use a predetermined amount and located all of it at a time. Meaning should your extent of project or any other expense expands, you will need to come across a supplementary capital origin. House collateral financing also have settlement costs and you can fees you to definitely eradicate the degree of your loan. One another family equity loans and you will HELOCs come with the risk of shedding your house, whether or not this really is a worst-situation scenario.

Positives and negatives away from domestic guarantee lines of credit (HELOC)

HELOCs promote way more independence than property security financing. Because you can take-out loans as required, you just need to pay appeal towards count you truly spend. You can start repaying interest immediately, however, costs in your dominant usually do not start until pursuing the detachment period. The newest malleability means they are a good idea for longer-identity renovations which have not sure costs.

Variability with HELOC rates of interest, although not, makes them a little challenging to create throughout the years. Industry requirements can transform HELOC rates from inside the life of the mortgage, leading them to at risk of circumstances affecting the latest discount. Payments changes also, and frequently borrowers wind up using a lot of on this new end of one’s loan’s label to cover outstanding loans.

Get a hold of your home equity financing price

Of a lot factors influence domestic security mortgage costs, for instance the financial you decide on. To make certain you’ll receive a knowledgeable price offered, shop loan providers and you can examine rates and you will loan terminology.

Comment closed!