Financial interest levels is actually switching quarterly because they’re connected with repo rate off initially . One should listen to refinance your financial to possess a diminished family interest rates in the event the qualified and you can appropriate. Learn qualification, due-diligence, benefits, charges, and the ways to strategy the lending company.

Home loan re-finance is the process of providing yet another mortgage of a separate lender to settle an existing financial. There are a few reason it’s also possible to refinance an effective home loan. When you get a mortgage that’s giving a lower interest, you could re-finance the mortgage to keep on the desire. However, there are many more reasons to refinance a home loan. Ahead of refinancing your home mortgage, you need to be sure that they masters both you and because of the how much. Here, we glance at the procedure of refinancing home financing.

step one. Check your eligibility

You can pick a mortgage refinance for those who have reduced the absolute minimum number of EMIs. As well as, your house will be filled or ready to be occupied. Speak to your present lender to know whether you are eligible. And, a home loan re-finance choice is best suited should you choose they into the first 5 years of your own installment period . It is because that is the date when the focus parts of your own EMI is at the highest. If for example the home loan possess finished 50 % of the newest tenure or perhaps is drawing near to the conclusion brand new tenure, it might not operate in their go for.

2. Carry out owed-diligence

Once we have observed, down rates of interest are among the main reasons why to help you re-finance a mortgage. Before you could re-finance your home mortgage try to keep a virtually check out into the interest movements. A slipping rate of interest regime is reasonable in order to re-finance the loan. This will gamble an important role on your own re-finance decision.

Quick Facts

Around the globe, casing is regarded as a way of long-term wealth buildup and you will monetary balance. India’s broadening populace of 1.4 mil (because towards the 23rd ) anybody located in a segmet of thirty two,87,263 square miles. This new thickness of populace works out so you’re able to

45%* of your housing when you look at the Asia are considered nearly as good each particular requirements. Brand new need for brand new construction are broadening relaxed.

step 3. Measure the positives

Just before refinancing home financing it is vital that youre certain of exactly why you should refinance your property loan and you will have a concept of advantages. Lower interest levels are payday loan Joes one of the popular reasons why you should refinance your property loan . Also a moderate interest rate difference can indicate a difference on your monthly EMI outgo. Assess just how much EMI you’ll cut immediately following their refinance your residence mortgage with a new financial.

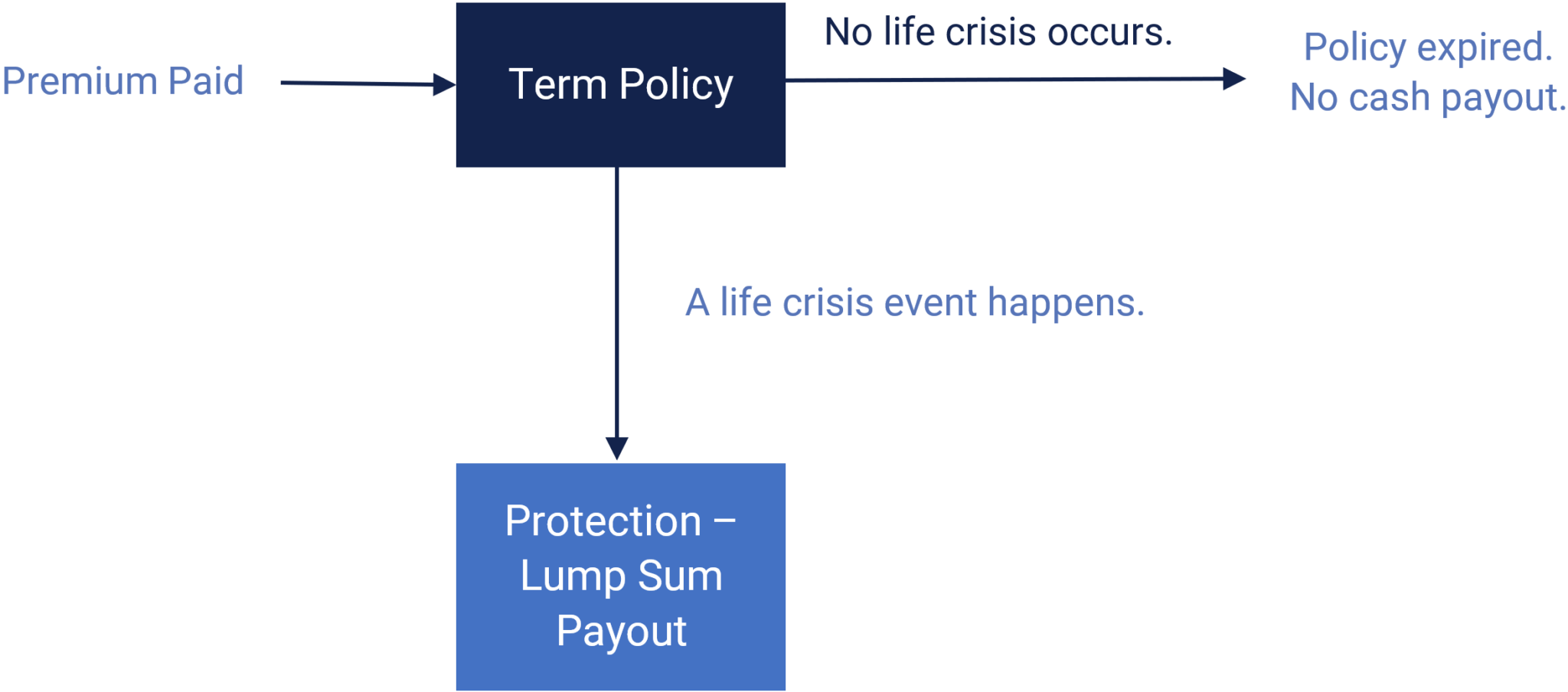

You need a mortgage EMI calculator so you can with this specific step. But not, there can be other reason why we need to refinance your own mortgage. It’s also possible to change from a predetermined rate financial to a drifting rates mortgage or vice-versa. You’ll be able to turn-to re-finance home financing for folks who aren’t happy with the services of its present lender. Refinancing your residence financing may give you eligible for a beneficial top-right up mortgage. Evaluate these alternatives also and weighing advantages and you will drawbacks.

Possibly, based on your percentage background, the is able to negotiate your interest rate even after your existing financial. Glance at, if this choice is available to you.

4. Know the charge

Even when its a refinance, new financial often address it eg offering an alternate domestic mortgage. Thus, you will find some fees on it which you must be alert regarding. Any of these certainly are the handling percentage, valuation payment, stamp obligation payment, legal percentage and the like. It is important to thought each one of these charges once you see the pros.

5. Connect with your lender

You should confer with your existing financial to re-finance your mortgage. For this, your existing bank will provide you with certain records. A person is new zero objection certification. The other is actually a file you to says the information of a great amount. You also need a property foreclosure page. Along with this you also need to get most of the financing associated documents on the bank’s custody. Certain banking companies require that you go to the department to get the files.

six. Strategy your brand-new financial

The next step is in order to means your brand-new financial thereby applying for the financing refinance. New financial would want all of your current KYC records and facts of money, along with Taxation Productivity over the past 3 years. If you don’t recorded yet, speak to and take Specialist helped They Filing to help you. You might must also fill out other financing associated data files.

Completion

A home loan refinance can help you save into the appeal will set you back and have now give you peace of mind. Once you have done your quest, it ought to be a fuss-100 % free processes. Check the latest financial rates of interest and commence the process. All the best !!

Comment closed!