- Detailing one pecuniary hardship: Mortgage amendment software need you to prepare yourself a monetaray hardship report. Erin prepares one file for you so your financial situation is actually accurately and you can entirely explained to the mortgage servicer.

- Getting ready the application: Financial modification programs is going to be problematic. If any records was unfinished or shed, your application could be refuted. Erin tend to ready your application for you, get your signatures to the an impression-free base, and you may fill out they electronically on the financial servicer. Their unique paralegals after that label their mortgage servicer on a weekly basis in order to push your application from acceptance techniques.

- Assaulting for your requirements in the eventuality of refusals or denials: In some cases, lenders may refuse a home loan amendment otherwise deny it altogether. It because of difficulties with the program, or it could be one a loan provider are pretending illegally. Erin is the endorse contained in this process. She’s got filed a couple of legal actions inside government judge facing home loan servicers who have wrongfully would not customize their unique clients= lenders. Those people readers have chose their houses and you can decades by the an excellent jury because of their measures inside denying your house loan mod needs she filed to have their particular website subscribers.

What Data Will i Have to Get ready for home financing Amendment?

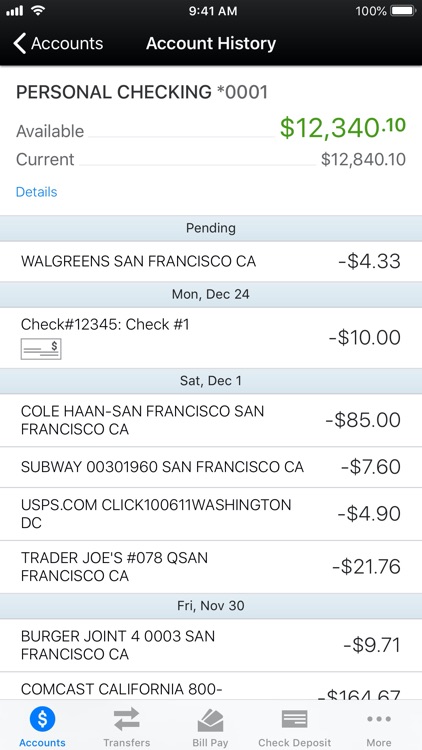

You’ll save big date for people who ready yourself a number of the required activities before you could talk with a talented attorneys. For source, you should give one correspondence you’ve got gotten from the collector, financial, or mortgage lender. You really have acquired announcements off delinquency and additionally even offers of mortgage loan modification C provide people formal letters you have got inside your fingers and you can bring your home loan report also. Additionally, render financial comments out of at the least during the last a couple months. This should help you as well as your attorney determine the money you owe. Expense and you will taxation statements will help with this particular, as well. It’s also advisable to have latest paycheck stubs or any other research of income statements.

Is actually a mortgage Amendment Right for Me?

A home loan amendment could be a good fit for your requirements. We explore home loan adjustment when they’ve suffered an excellent monetaray hardship. You will be dealing with an adversity immediately. not, you might think it’s possible and work out smaller otherwise altered payments later on. If that’s the outcome, home financing amendment may do the job. For those who have sufficient income to invest a customized mortgage in your primary home, it is possible to be eligible for a loan modification.

Do Applying for a loan Amendment Prevent Foreclosures?

A mortgage amendment could possibly avoid foreclosure. It is important to consult an attorney concerning your problem as quickly as possible. Generally, lenders aren’t lawfully allowed to manage dual recording. Dual tracking happens when a lender pushes submit with a property foreclosure while sharing home financing modification. While you are against a property foreclosure, consult with Erin about how precisely that loan amendment may help you.

My Loan mod Is Refused, So what now?

There are some available options should your mortgage loan modification is declined. You happen to be in a position to attention the option, or you might possibly work on your lender to help you discuss a different sort of contract. Chapter 7 Bankruptcy proceeding could be a choice. Almost any station you are taking, preserving an experienced loan mod attorneys such as for example Erin can be boost your chances of victory progressing.

Must i However Make an application for HAMP?

At the time of has ended. The existing system offered residents who were having trouble while making the mortgage payment as the housing market sustained. Though HAMP has ended, all the home loan servicers and people must offer mortgage adjustment on their delinquent consumers. Erin are familar toward conditions of every servicer and will handle your case on your request for a home loan amendment. Home loan modification can invariably prevent a foreclosure. The procedure of see web site modification can invariably confirm beneficial to the newest creditor and you can borrower, nevertheless are going to be hard to browse the brand new state-of-the-art means of making an application for an amendment into the a delinquent home loan whilst retaining your home and you can blocking you to same financial of foreclosing toward it. Residents striving economically may use the assistance of an experienced domestic loan modification lawyer.

Comment closed!