The newest Government Property Government has increased new financing thresholds for its Identity We Were created Financial System into the a quote to help you open the available choices of sensible construction.

The new FHA’s choice to boost brand new constraints will finest fall into line which have current market pricing having are formulated property, known as mobile belongings, and also the accompanying lots. Which improvement is expected to help you quick a lot more lenders to increase fund to people looking to get are available home.

It mortgage limitations since the 2008 and that is element of President Joe Biden’s initiative to enhance the fresh new the means to access and using are made belongings because the an affordable property provider.

New updated methodology to possess choosing and you may revising the fresh program’s limitations is in depth inside a last signal put-out towards Feb. 31, as the detail by detail when you look at the a news release by FHA.

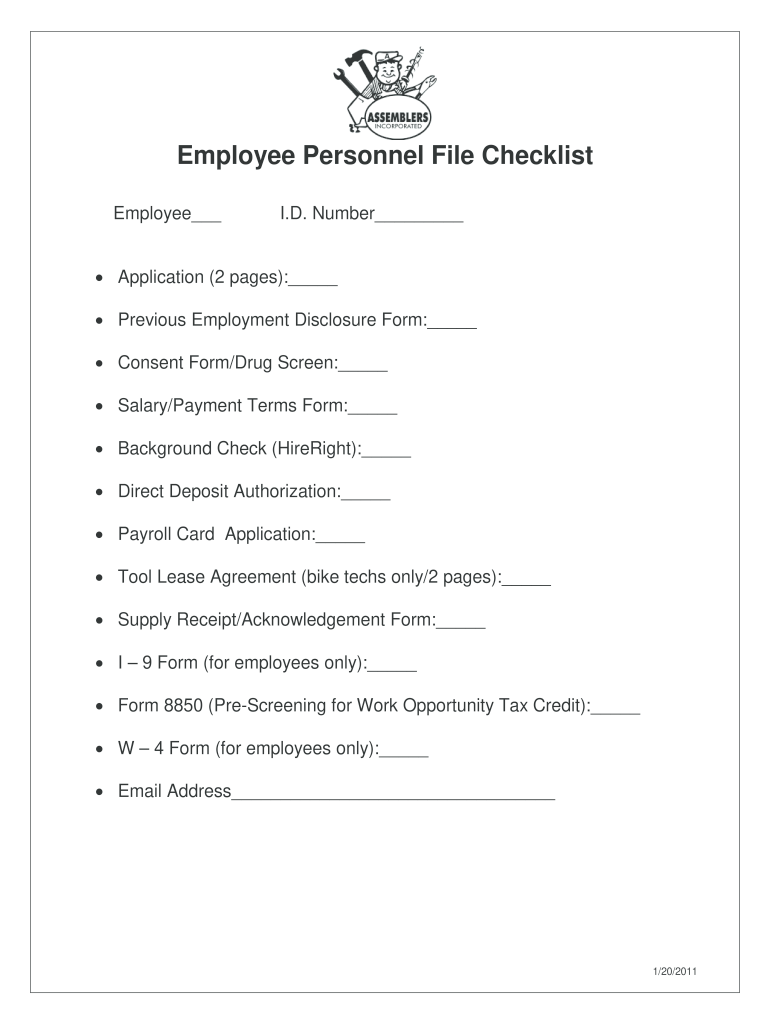

The fresh changed are built financial limits are as follows:

- Integration loan (single-section): $148,909

- Consolidation loan (multi-section): $237,096

- Are formulated financial (single-section): $105,532

- Are made mortgage (multi-section): $193,719

- Are designed domestic parcel mortgage: $43,377

Julia Gordon, Government Construction Commissioner, highlighted one updating the fresh Label I mortgage restrictions stands for a critical part of lingering services to compliment the fresh new Identity I Are created Home Financing Program’s capabilities having lenders and you will homebuyers. She indicated guarantee these customizations would remind even more lenders in order to consider using brand new Name We system to fulfill the financing requires from customers to order otherwise refinancing are designed land.

Some novel credit companies give Federal national mortgage association mortgages through the MH Advantage program for people looking to money to have a manufactured family. Appointment certain eligibility criteria is essential, with creating our home having a driveway and you can a connecting pavement for the garage, carport, otherwise detached garage.

To help you be eligible for this option, the new are designed household must adhere to particular structure, structural structure, and energy show criteria comparable to those getting web site-based home.

It home loan software provide 31-seasons financing, and it’s really you’ll be able to so you can secure these with a down-payment due to the fact lowest because the step three%. On the other hand, MH Virtue mortgage loans will feature straight down home loan rates compared to the of many conventional money getting are available home.

Fannie mae Fundamental MH: It loan alternative provides home that do not meet up with the qualification conditions of your MH Advantage system, related antique unmarried- and double-broad are made home.

Yet not, unless of course it’s within this an effective co-op or condominium endeavor, the fresh new debtor have to very own the house where home is oriented. The new are designed household has to be built on a permanent framework, attached to a lasting base on property owned by the brand new debtor, and you will entitled given that a property. These finance may have fixed- or adjustable-rate formations, having terminology stretching as much as 3 decades (360 months).

Think good Freddie Mac Are available Home mortgage

Such mortgage loans to possess manufactured home are easily obtainable in really claims, providing one another fixed- and you can varying-rates selection. New home must be into a long-term foundation and certainly will getting placed on personal property owned by this new debtor, during the a well planned invention otherwise enterprise, or, having created consent, on the leased home. For those who have borrowing from the bank difficulties rather than enough money having good down-fee, imagine a rental for loan.

Should i score property Equity Loan loans Denali Park AK to your a manufactured House?

Sure. There are lots of financial firms that offer HELOCs and you can collateral finance to help you individuals making use of their are designed family given that equity. Many of these next mortgage lenders commonly anticipate you to have at least 20% equity of your home and get good credit results too. Inquire about household equity financing no credit assessment. Individuals need to know, Must i get an excellent HELOC towards a made house?

Make the most of the credit couples that offer home guarantee finance and you can a HELOC toward manufactured house. Brand new RefiGuide allows you to pick such credit companies in order for you could go shopping for HELOC fund speed today.

Comment closed!