As home loan drama out of ten years before could have altered how mortgage loans are supplied, the financial institution report loan program has been readily available underneath the best situations. Such non-certified mortgage requires specific files to the deposit and money, nevertheless would be a good option non-qm mortgage selection for tens of thousands of worry about-employed individuals who need to get an interest rate.

Just how can Financial Report Financing Functions?

Financial report funds was often referred to as said earnings. When the a debtor had a sufficiently sufficient credit rating, usually 700 or higher, then home loan company would allow brand new debtor to obtain an excellent financing rather than bringing tax returns, lender comments, and other particular papers.

If you find yourself progressive lender declaration finance commonly that simple, it still offer a beneficial credit choice to people who own their own businesses.

Smart business owners hire elite income tax accountants to assist them to just take benefit of every income tax legislation and reduce their company earnings that have legal write-offs, hence decreasing its income tax liability at the end of the year.

not, the low money advertised to your taxation statements suppress advertisers of being qualified with the home of the fantasies. And here the exact opposite paperwork can come inside the handy and you will allows loan consumers to make use of financial comments to prove its money in another way.

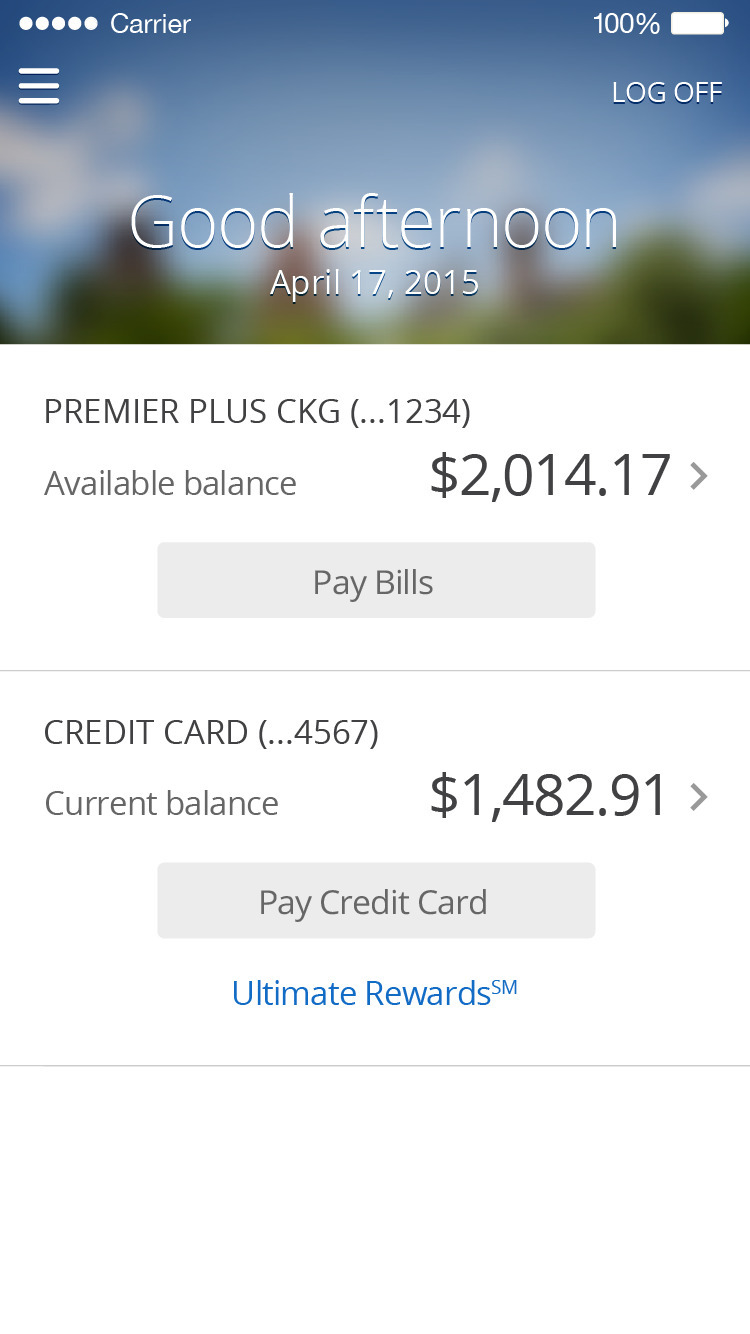

The alternative documentation uses your bank statements regarding 12 months or even 24 months. Financial comments will teach deposits in the family savings along side lasting and you can signify the organization are producing income the residents are utilizing because of their individual fool around with.

Lenders commonly average all the eligible places after which fool around with a share number of the common to determine the borrower’s yearly income.

Head Advantages of Such Home loan against a traditional Financial

- Individuals is also qualify for a high amount borrowed versus money advertised to their tax statements.

- Doesn’t need tax statements and other proof shell out

- Off payments is just as low since ten%

- Quite large Interest rates for these funds than just prices having mortgages offered by Freddie Mac and you may Fannie mae

General Recommendations to your Worry about-Employed Financial Borrower

In advance of plunging on one among these mortgage loans, consumers should be conscious of the essential criteria observe if they be eligible for the borrowed funds

- All borrowers must be mind-functioning. In addition, make an effort to demonstrate that you have been self-useful a couple of years minimum together with your newest company

- The minimum deposit to have a buy was at minimum 10%

- Individuals will need to bring duplicates of individual otherwise business bank statements to be considered as opposed to tax returns (depending on where money is actually placed) for the past a dozen in order to a couple of years.

- Borrowers needs sufficient reserves that can are very different oriented into several things. The financial institution might verify https://paydayloanalabama.com/walnut-grove/ all the assets.

Jumbo Bank Statement Mortgage System Selection

Jumbo mortgages have been around for some time however, so you’re able to be eligible for a loan can be more restrictive than simply conventional finance. Enhance that proven fact that of a lot jumbo mortgages require an effective 15% deposit or maybe more, and realise why someone timid from such marketing.

It home loan removes those types of barriers. So long as you have a credit history of at least 620, along with the required reserves, so it mortgage would be a terrific way to make it easier to funds your next jumbo home get.

Investment Functions

Individuals who are thinking-employed and possess achievements within businesses are always selecting a way to broaden its financial investments and create wide range for the future. One of the most common suggests is actually to get investment property like just like the accommodations possessions or a multiple-product building. Lender report finance can help with that it also.

A vintage mortgage getting an investment property would require the fresh borrower to document the personal earnings which have taxation statements, W-2 versions, and you can company tax statements because of their company. They might plus want to pick income and you will losings declaration into implied investment property one shown yearly rent earnings, opportunities, and you will required repair fees.

Financial statement funds make it a lot more straightforward to purchase a good investment assets. Having a down-payment between 20% so you can 25%, licensed consumers should buy a house and start to the roadway to be a landlord. The fresh new put aside conditions said prior to are nevertheless ultimately for a financial investment financial too.

Cash-Aside Re-finance

This choice is not set aside simply for pick transactions. Using the same credit score, bucks reserves, and you may amount borrowed criteria, individuals having present mortgage loans can also apply for a funds-aside refinance mortgage. The exact same laws usually get a lender declaration refinance.

Certain Terms to own Repayment

There are many different repayment conditions, identical to a traditional financial. Consumers will get prefer a 30-year repaired financial otherwise one of the numerous adjustable price financial programs such as for example a beneficial 5-year Case or 7-12 months Sleeve. Interest-just is even an offered choice however, most other restrictions go with they.

Vendor Concessions are Allowed

To buy a property brings involved the desired settlement costs. These are can cost you repaid on appraiser, closure attorney, or other companies you to be involved in the mortgage techniques. To aid consumers with regards to dealings, this option enable suppliers to help you lead around 6% of your residence’s cost into closing costs.

When it might be negotiated amongst the real estate agents correctly, it will help reduce the borrower’s complete away-of-wallet expenses during the time of closure.

Summing up The financial institution Statement Real estate loan Program to possess Mind-Functioning Consumers

To own mind-operating people with a powerful credit score and you can a healthy wet-day funds, this new strain of lender statement mortgage loans would be the treatment for purchase property otherwise investment property without any typical paperwork of a typical mortgage.

Comment closed!