Entrepreneurs and you may enterprises usually see by themselves within a good crossroads the spot where the best economic support tends to make all the difference. A business mortgage, in this context, are an effective resource that can help drive a corporate to your the specifications. Let us explore seven really persuasive reason entrepreneurs must safer a corporate loan.

1. Kickstarting a unique Team

One of the most common reasons to receive a corporate financing will be to release a new campaign. Installing a corporate demands a life threatening investment. Out-of protecting site so you’re able to procuring initial list and you can recruiting group, the expense make sense. A corporate mortgage ‘s the backbone support these early-stage requirements, making sure entrepreneurs is also work at building a viable and you will effective providers.

dos. Fueling Organization Expansion

Development was a life threatening factor in an effective organizations travel to achievement. Be it the necessity for a bigger workplace, launching new products, or broadening so you can the new geographic cities, gains demands investment. A business loan lets advertisers to gain access to money necessary to do expansion arrangements efficiently. They makes it possible for make generous opportunities as opposed to deteriorating its working resource.

step 3. Upgrading Gadgets and you will Equipping Directory

Results and preparedness try critical into the ensuring easy procedures. Given that tech evolves and you may means changes, updating devices and you will maintaining a robust collection become very important. Loans intent on gadgets money otherwise collection procurement make certain that the organization can maximize abilities, satisfy buyers demands, and become aggressive.

4. Consolidating Expenses

Juggling several costs, for each using its own rate of interest and you will fees agenda might be difficult and you can economically pushing. Debt consolidation thru a corporate financing streamlines this action. Of the combining multiple expense on just one loan, people can frequently safer significantly more good rates and you will clear up their economic management.

5. Assisting Providers Acquisitions

Acquiring a preexisting organization or merging with a unique is going to be a proper move for expansion and you will variation. Although not, particularly acquisitions have a tendency to learn the facts here now have a hefty price. Loans also have the latest much-called for capital so you’re able to facilitate such purchases. Of the meticulously considering the possibility output and you will formulating a strategic integration plan, business owners can use loans due to the fact levers to elevate its business position courtesy acquisitions.

6. Improving Sale Efforts

Right now, the marketplace is extremely competitive, and active selling are essential. Regarding digital promotional initiatives so you’re able to antique advertising models, building a brand visibility and drawing a customer base demands monetary financial support. A business mortgage is assistance this type of purchases initiatives, allowing enterprises to allocate enough tips to grow and you will do impactful income strategies.

eight. Approaching Unexpected Expenditures

Businesses often face unanticipated expenditures should it be an urgent situation resolve, a regulatory good, or an unexpected chance. These situations require immediate financial appeal. A corporate financing is going to be good lifeline this kind of problems, providing the required loans to deal with this type of expenditures without hampering brand new typical cashflow.

How to pick the best Company Financing

In relation to a corporate loan, it is vital to become familiar with the particular means, have a look at different financing circumstances, and learn its words. As an example, a lengthy-label loan could well be appropriate for company extension, while a personal line of credit could be finest suited to approaching unanticipated expenses.

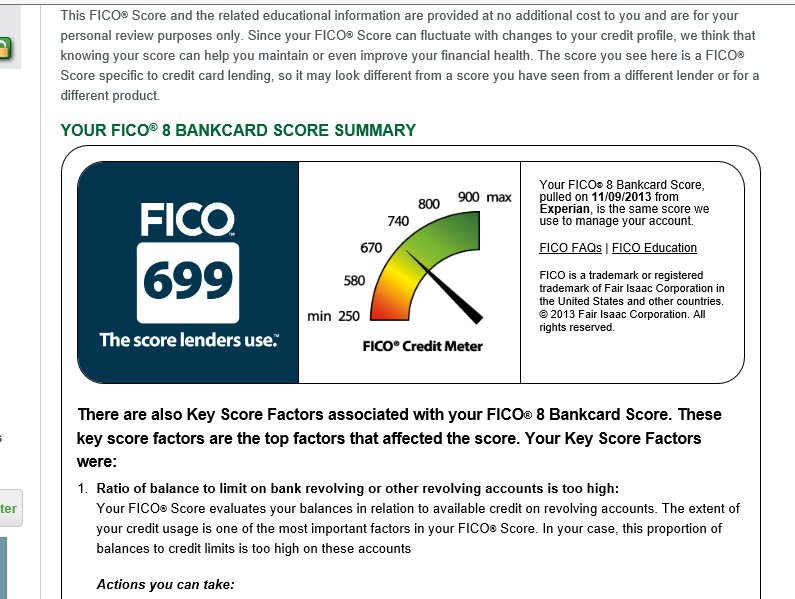

Preparing a strong business strategy, keeping good credit history, and having obvious monetary projections often boost the odds of securing a good team mortgage.

Contact InterBank Right now to Start off

Protecting a corporate mortgage try a strategic circulate you to, when carried out intelligently, is also produce significant dividends. If providing wings to a different business idea, cultivating growth, or making certain that the fresh agency runs efficiently, loans is actually a keen entrepreneur’s friend within the building and you may sustaining profits.

InterBank try dedicated to help business owners that have tailored business financing selection. With your varied loan products and a group of advantages, we’re here so you can helps their organization’s financial demands. Spouse with InterBank, and you can why don’t we be a part of your success tale.

Comment closed!