Enhancing your loan profile is vital to ensure a wholesome and you may effective financing team. As your financing collection means a critical house and you may a source away from chance for your institution’s safeguards, soundness, and you may growth, using energetic steps is essential.

Pressures so you can Boosting your Financing Profile

Prior to delving on strategies, it is vital to admit the problems regarding the enhancing your loan profile and achieving financing progress.

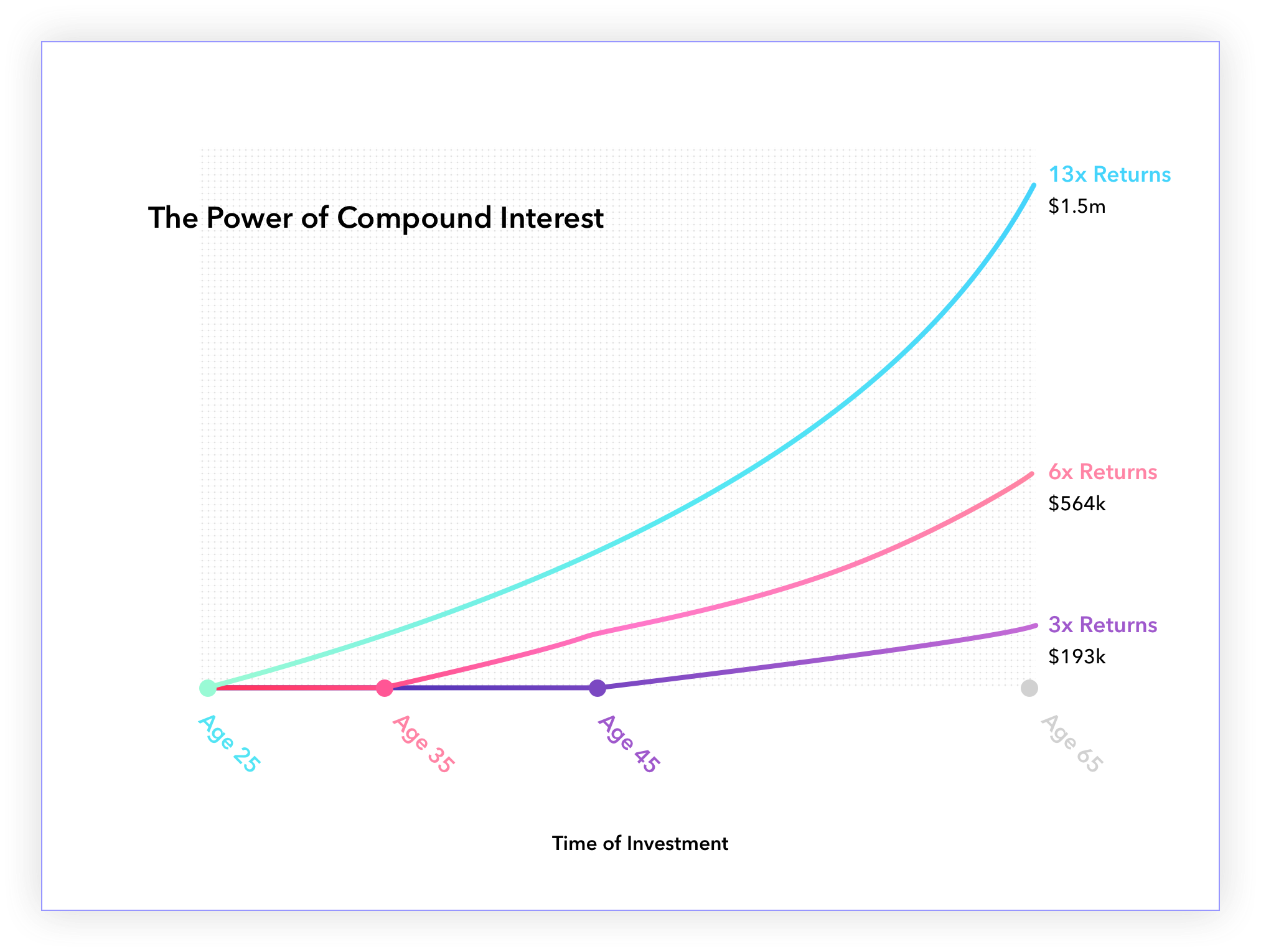

Financial institutions greatly believe in money just like the an initial way to obtain earnings, boosting financing portfolios important, especially in the current year. Within the a study used of the Jack Henry, two-thirds regarding establishments showcased the necessity of expanding the loan portfolio given that a key purpose.

But not, navigating a beneficial choppy economy normally establish barriers to help you consumers seeking to open people otherwise make high sales particularly home or automobiles, particularly with prevailing highest-interest rates. Therefore, boosting loan collection gains get show to be a challenging processes about upcoming 12 months.

- Financial Suspicion: Navigating an explosive monetary surroundings is twist demands getting consumers and you will loan providers alike, impacting financing consult and you will installment capacity.

- Interest Fluctuations: Prevailing highest-rates may deter possible consumers out-of seeking finance, affecting mortgage collection progress.

- Borrowing Risk: Evaluating and controlling borrowing from the bank chance is important, due to the fact default rates normally undermine the healthiness of the borrowed funds collection.

- Diversification: Balancing the borrowed funds collection with varied loan types, terms, and you can cost can be difficult to cater to certain buyers locations.

- Borrower Degree: Making certain individuals completely understand mortgage products and the requirements will be an obstacle for the minimizing standard prices.

- Studies Administration: Leverage complex data statistics requires powerful research government structure and operations.

- Regulating Compliance: Staying with ever-evolving regulatory requirements necessitates proceeded keeping track of and you can updates so you’re able to financing formula.

- Sector Race: Fighting together with other financial institutions having a portion of the credit business requires proper distinction and you may consumer-centric offerings.

- Non-Undertaking Loans: Effectively approaching non-undertaking money need proactive methods to shed loss and you will manage chance.

Such challenges emphasize the necessity of active strategies to maximize your loan collection and ensure enough time-identity achievement about lending community. Which checklist is daunting, but we’ve got intricate certain proactive methods to let decrease these types of challenges less than.

How to Change your Financing Portfolio

About ever before-developing lending landscape, becoming ahead means a hands-on approach that leverages cutting-border technical and you will day-looked at steps. Because financial institutions make an effort to make certain an excellent and you may winning financing organization, the main lies in increasing their mortgage collection. A well-optimized financing profile bolsters the fresh institution’s financial power and reduces potential threats while providing to diverse customer areas.

Optimizing Loan Profile: Technology and methods getting Development

Achieving a highly-enhanced loan profile demands proceeded overseeing, study, and you will versatility. Because of the using these types of carefully curated methods, loan providers and you may loan providers can also be escalate its loan portfolio results, decrease dangers, and build a more powerful and more renewable financing business, positioned for success in today’s aggressive monetary landscaping.

Automation and you may Digitization: Streamline financing processing and you may repair with tech. System automation increases overall performance, eliminate errors, and speed up loan approvals.

Mortgage Giving Diversity: Provide so much more mortgage situations so you’re able to cater to additional customers avenues. You might broaden by offering other loan versions (auto, personal, mortgage), words, and you can cost. You are not counting way too much on a single form of loan, that will help get rid of chance.

Debtor Knowledge: Improve individuals in the loan products and the requirements. Raise debtor satisfaction and disappear default pricing from the communicating terms, fees times, and you may later fee outcomes.

Data-Determined Underwriting: Power state-of-the-art research statistics and tech making most useful lending choices. Gauge the borrower’s creditworthiness, installment capabilities, and risk character. Data-determined underwriting can aid in reducing default prices and do risk top.

Display Collection Show: Get acquainted with the loan portfolio daily to recognize fashion and you may potential risks. Monitor delinquency pricing, default prices, or any other key performance indicators. Of the identifying potential factors early, you could potentially mitigate them.

Quick Commission Incentives: Encourage into-date money through providing bonuses like straight down interest levels, shorter costs, or finest https://paydayloanalabama.com/marbury/ borrowing conditions once and for all consumers.

Chance Administration: Implement exposure government techniques to do away with losings in the eventuality of defaults. You might have to kepted reserves, score mortgage insurance, or hedge against sector dangers.

Customer support: Create trust and you can respect which have consumers giving excellent customer care. You’re more likely to rating repeat team and you can tips for those who build a good experience of your current users.

Financing Coverage Product reviews: Review financing rules and processes to make them in line with changing business criteria. That have versatile and you can agile loan products can help collection performance.

Consider, enhancing your mortgage profile needs ongoing monitoring, data, and you may adaptability. Using such procedures can enhance the loan collection results, cure threats, and construct a healthier plus green financing organization.

Starting

defi Options provides completely integrated financing origination, servicing and you can statistics application designed, establish and you may supported by credit pros. Which have age out-of industry feel, we welcome the chance to mention how exactly to improve your financing profile and your most other lending requires. Get in touch with we now or sign up for a trial.

Comment closed!