Consumer Conformity Mindset: Third Quarter 2013

Regarding the aftermath of your own overall economy, domestic possessions beliefs rejected significantly a number of areas. Responding, of many loan providers frozen home security lines of credit (HELOCs) otherwise smaller credit limits, carrying out compliance and you will reasonable lending threats. When you find yourself casing prices provides rebounded on downs of your own crisis, loan providers need certainly to remain attentive to their personal debt significantly less than Regulation Z whenever a critical lowering of a great property’s really worth you to definitely lowest interest rates refinance student loans invited a creditor to take such procedures has been cured. Financial institutions must accept brand new reasonable lending exposure associated with the such methods. This informative article brings an overview of the latest compliance standards and you may threats when a collector takes action to your a good HELOC due to a great improvement in worth of. 1

Control Z Compliance Requirements

Section of Controls Z imposes significant compliance requirements towards HELOC financial institutions. Which part not simply demands disclosure regarding package fine print and basically forbids a collector out of altering all of them, but from inside the given situations. You to definitely scenario providing a creditor to help you suspend an effective HELOC otherwise get rid of their credit limit is when the property protecting the newest HELOC enjoy a significant decrease in well worth, because the provided inside the 12 C.F.R. (f)(3)(vi)(A):

Zero creditor can get, from the deal or else … change people label, apart from a collector can get… ban more extensions of borrowing otherwise slow down the borrowing limit appropriate so you’re able to an agreement during the any several months the spot where the value of the dwelling you to definitely protects the plan refuses significantly beneath the dwelling’s appraised well worth having purposes of the plan. 2 (Emphasis additional.)

The newest controls cannot explain a good significant refuse. However, Review (f)(3)(vi)-6 of your Formal Professionals Reviews (Commentary) brings loan providers with a safe harbor: When your difference between the original borrowing limit additionally the available security is actually faster in two because of a property value decline, this new decline can be regarded as tall, providing loan providers in order to refuse additional borrowing from the bank extensions otherwise reduce the credit limit getting a good HELOC package.

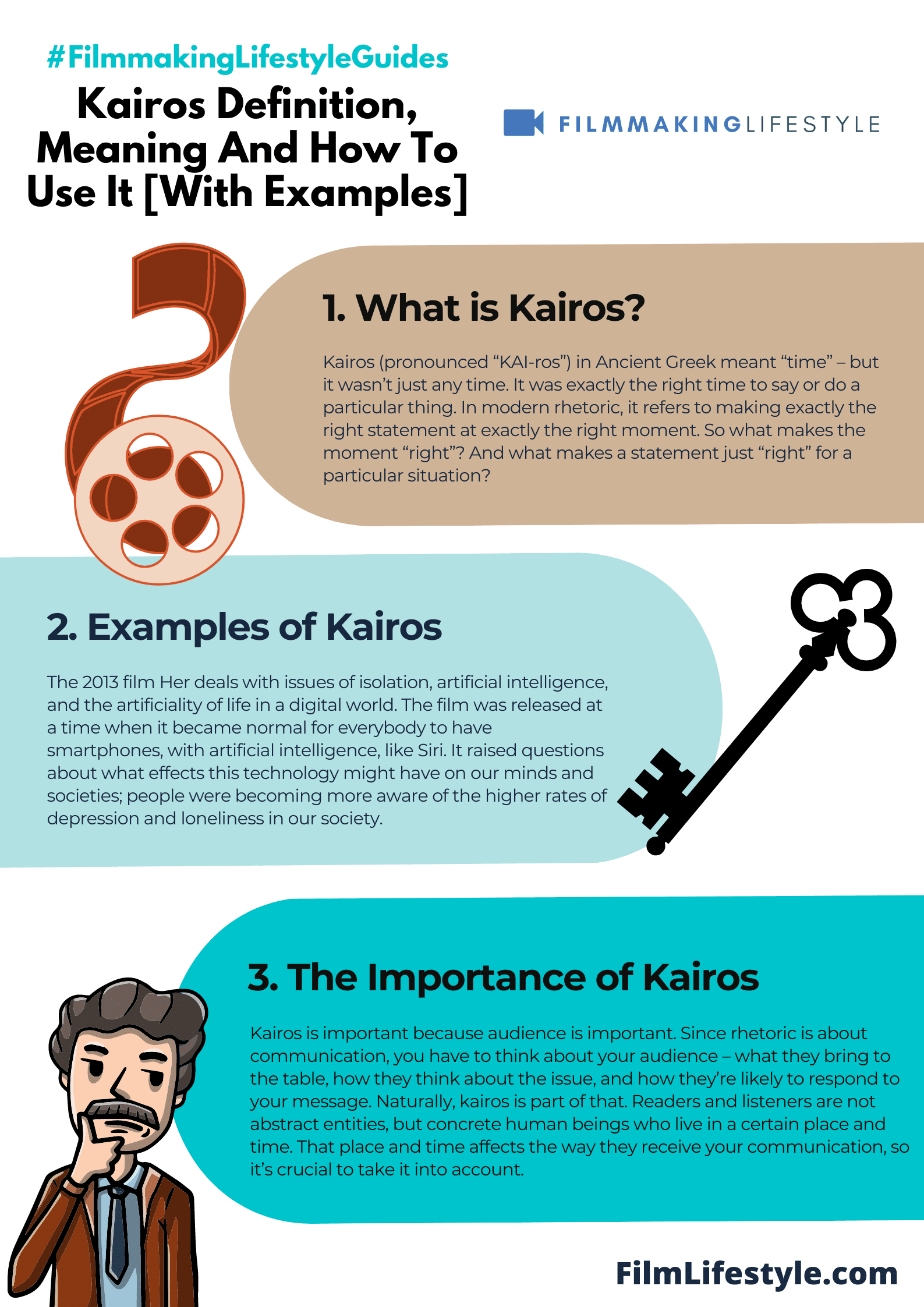

When determining if a serious reduction in worth has took place, creditors will be evaluate the dwelling’s appraised well worth within origination resistant to the current appraised well worth. The fresh new dining table less than brings an illustration. step 3

In this example, the brand new creditor you may ban subsequent improves or slow down the borrowing limit should your worth of the property refuses of $100,000 in order to $90,000. Administration is conscious you to definitely despite the fact that is allowed to slow down the borrowing limit, this new protection can’t be beneath the number of the brand new a fantastic equilibrium if performing this would need the consumer and then make a top fee. cuatro

Property value Steps

![]()

The latest creditor is not needed discover an assessment in advance of cutting otherwise freezing a great HELOC if household really worth has actually fell. 5 Although not, having examination and recordkeeping motives, the new creditor is to take care of the papers where they depended in order to present you to definitely a serious lowering of worth of took place prior to taking step on the HELOC.

In , the fresh Interagency Borrowing Exposure Administration Advice getting Home Security Lending are authored, which includes a discussion from security valuation government. 6 The fresh pointers brings types of risk government means to take on when using automatic valuation designs (AVMs) otherwise taxation testing valuations (TAVs). Next some tips on appropriate strategies for using AVMs or TAVs was considering throughout the Interagency Appraisal and you can Testing Recommendations. 7 Management may prefer to consider the guidance when using AVMs or TAVs to decide whether a critical refuse has occurred.

As well as regulatory compliance, establishments ought to know one to enough category step suits had been registered challenging the usage AVMs to reduce credit restrictions or suspend HELOCs. 8 The newest plaintiffs in such cases provides confronted various regions of compliance, such as the access to geographic location, in place of private property valuation, since a grounds to have good lender’s selecting away from reduced really worth; the AVM’s precision; plus the reasonableness of your appeals procedure positioned which a debtor may issue the brand new reduction of the fresh credit line. For the light with the legal actions risk, what is important to possess associations to pay consideration to help you compliance standards.

Comment closed!