That it declaration provides a professional review of your own property value an effective possessions considering some points and gives you a concept of if a sale pricing is lined up on economy worth of a property.

Definition of a house assessment declaration

A home appraisal declaration was a detailed evaluation away from a property’s value presented by a licensed elite group appraiser otherwise automatic valuation model (AVM) used by a loan provider. An important function of so it statement is to influence the newest fair market price out-of property, that’s crucial for people, providers, lenders and you may insurance firms. The fair market value ‘s the rate where a house you are going to logically promote in the open business.

Different kinds of appraisal tips

- Conversion process testing approach: The sales analysis approach is a type of strategy included in family appraisals. This method relates to contrasting the house or property being appraised in order to equivalent features recently purchased in an equivalent area. The latest appraiser considers issues instance dimensions, area, updates, places, and you may latest income rates out-of comparable characteristics to determine the really worth.

- Costs approach: The cost approach experience normally utilized for the fresh new qualities or unique characteristics you to use up all your equivalent conversion process research. They calculates the worth of the home from the deciding the purchase price so you’re able to reconstruct they, given points eg structure will cost you, land-value, and you may depreciation.

- Income method: The amount of money strategy is generally useful for financing qualities particularly rental equipment otherwise commercial houses. It prices the new property’s worth from the analyzing the money prospective centered on the local rental rates, expenditures, and prospective earnings increases.

Exactly what information find the newest declaration?

- Previous transformation of comparable qualities in your community

- Most recent condition of the home

- The local as well as impact on coming worth

Recent conversion

An enthusiastic appraiser often opinion the fresh new info of nearby qualities sold out-of the previous few months otherwise days to acquire three or four that will be similar sizes, build and build. The brand new price ranges of these land will assist determine the importance of the property are appraised. Many customers and manufacturers want to know how recently the fresh new equivalent home was in fact offered, and what’s defined as when you look at the same urban area.

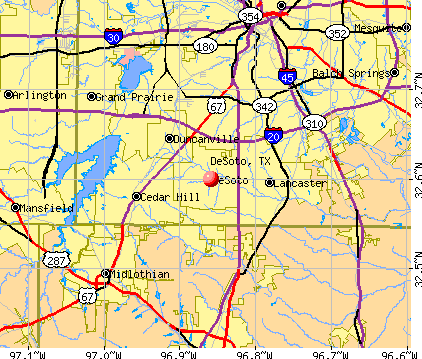

The newest variables are very different anywhere between home within the a metropolitan city plus an outlying people. Inside a more impressive area, the new appraiser may find equivalent belongings one available in the past week and in one distance of the home that’s to possess product sales. In the a little urban area otherwise outlying community, one to appraiser may have online payday loan Lake Chaffee CT to envision conversion more months or expand brand new fringe to help you involve the entire city otherwise several kilometers.

Latest position

An enthusiastic appraiser have to evaluate the newest position of your attempting to sell property to choose its really worth. He/she usually scan your house for all the health insurance and questions of safety. One abuses otherwise risks was listed about final declaration. These may tend to be old wires, insufficient railing with each other staircase and many other conditions. At exactly the same time, new appraiser usually gauge the full form of the house. Could it be like someone else in the community or perhaps is they a lot more than otherwise less than all of them? A home that needs serious upgrading are certain to get a reduced assessment well worth than one that has already started refurbished.

The neighborhood

The encircling neighborhood plus plays a part in this new assessment. The fresh new appraiser have to dictate the modern state of your area and you will where it is going in the future. Including, a home inside the a unique or up-and-upcoming subdivision are certain to get a high well worth now, because it’s likely to upsurge in the long term. At exactly the same time, a property for the a sleepy-lookin society that’s e prospect of well worth.

Comment closed!