Idaho, brand new Treasure County, is not just recognized for its famous carrots, but also for their sturdy housing market. New supply and great things about HUD housing finance into the Idaho enjoys generated homeownership an actuality for almost all owners. An engaging reality regarding Idaho’s housing market is the fact this has already been one of many fastest-expanding in the nation, having home prices increasing notably over the past long-time. Which development, coupled with the support away from HUD houses finance, made sensible homes more available to Idahoans.

County Housing industry Evaluation

The latest housing marketplace within the Idaho could have been experiencing an increase during the recent years. Based on investigation regarding HUD and you may state construction authorities, home values was on a reliable go up, so it’s a great seller’s sector. However, it has plus triggered casing affordability pressures, specifically for earliest-time homeowners and you will lower-income families. Despite such pressures, significant homes improvements and you may tactics was indeed started to meet up with this new broadening demand.

Demographic manner are impacting the brand new homes consult from inside the Idaho. The official keeps seen an influx of brand new residents off their states, drawn of the Idaho’s natural splendor and standard of living. It offers contributed to an increase in need for housing, subsequent riding upwards home values. Although not, HUD casing fund was indeed crucial in assisting each one of these brand new residents safer sensible casing.

Monetary Landscaping and you may Market Styles

Idaho’s fiscal conditions play a significant role in shaping the housing field. With respect to the newest analysis on the Bureau regarding Labor Analytics while the U.S. Census Agency, Idaho has actually an effective economy with secret a career sectors inside the agriculture, production, and you may technical. These groups promote stable employment opportunities, drawing folks from across the country and you will leading to the new country’s population development.

The presence of tall instructional establishments and you may healthcare facilities together with has an effect on Idaho’s housing marketplace. This type of organizations attract children and health care experts who sign up for brand new need for property. Regardless of the challenges posed by ascending home values, HUD construction financing have been a critical money for some Idahoans, providing them to browse the fresh nation’s dynamic housing marketplace effortlessly.

Today’s Interest levels in Idaho

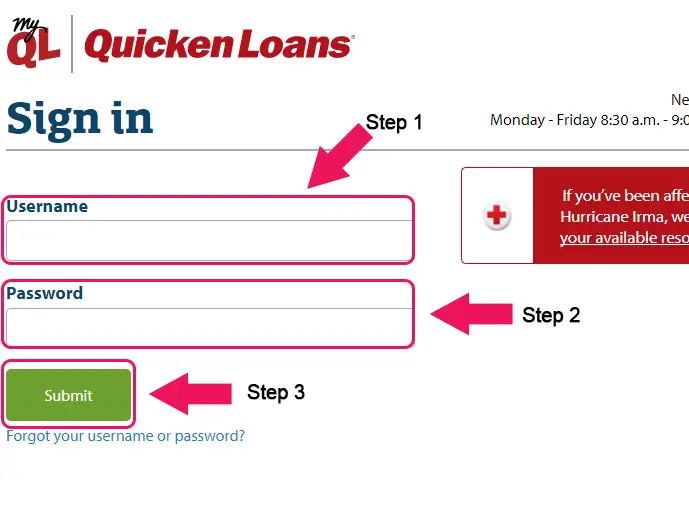

Please note these are only standard directory cost – per mortgage device get a speeds you to varies depending on the property, the region, this new borrower’s monetary energy and you can sense, and many additional factors.

Our Advantages

With regards to taking a great HUD loan for your multifamily possessions, there are many incredible options. The newest names of fund themselves are maybe not eg detailed, although not – alot more alphabet soups than just right name – yet he has big variations in purpose, qualification, and terminology.

All of us connects you which have loan providers across the U.S. to find the best money conditions for the assets, no matter if one works out becoming beyond your realm of HUD financing. No matter whether you are to invest in or building, remodeling otherwise broadening, hunting the loan so you’re able to several loan providers puts your during the a robust updates to select the credit conditions you to meet your needs.

The educated class out-of financing segments advisors will supply ab muscles finest terminology from your unmatched circle out of lenders to ensure the property has got best site the ideal funding conditions available. We provide this particular service free of charge.

Looking addiitional information on the Idaho? Keep reading less than. If you don’t, click on the button lower than, and we will score back for your requirements along with your totally free multifamily mortgage price.

Most recent HUD Multifamily Loans into the Idaho

Discover numerous HUD financial support alternatives for multifamily properties into the Idaho. Continue reading to know what type could be the most appropriate for your assets.

HUD 223(f) Financing

An excellent HUD 223(f) financing are an incredibly versatile financial support choice which can be used on acquisition or refinance regarding a good multifamily assets with an increase of than simply four equipment. Having much time, fully amortizing terminology, repaired rates and large LTVs, these fund could possibly be the most readily useful funding vehicle discover a multifamily possessions.

HUD 221(d)(4) Funds

The new HUD 221(d)(4) financing ‘s the high-power, lowest-pricing framework mortgage readily available for a beneficial multifamily invention. Giving terms of as much as 43 many years within a fixed desire rate, that it financing may be very popular with designers for good reason. Throughout framework, the borrowed funds is notice-merely (for three years), and abreast of conclusion the fresh new notice has a completely amortizing, 40-year title.

HUD 223(a)(7) Fund

Timely isn’t the majority of some one might think off after they think of going a HUD multifamily financing. Yet not, a good HUD 223(a)(7) financing even offers each other rate and you may ease, which have less reports and you may files necessary. Meanwhile, this program also provides loans that have extended, totally amortizing words, and you may low, repaired rates from inside the a non-recourse plan.

Keep in mind that whenever you are an excellent HUD 223(a)(7) loan are a stunning alternative, it is only designed for services having established HUD multifamily debt.

HUD 241(a) Financing

If you prefer supplemental money to suit your flat building in Idaho, a beneficial HUD 241(a) loan might be an effective solution. Such fund was non-recourse and gives investment in the a loan-to-cost proportion from ninety% getting to possess-profit organizations and you may 95% to own nonprofits. You need a preexisting HUD financing on the flat strengthening otherwise medical care property to qualify.

Interest rates was fixed, and loan’s title length generally usually satisfy the title of this new elderly HUD financing towards the possessions, even if oftentimes this label will be prolonged around 40 years.

HUD (f) Loans

HUD’s health care assets loan, the brand new (f) financing, is similar to this new previously mentioned HUD 223(f) financing choice. Useful to invest in or refinancing health care services (together with skilled medical and nursing facilities), the loan comes with certain restrictions with respect to industrial place. not, the great benefits of a good thirty-five-12 months, fully amortizing label within a fixed speed is actually unequaled on the medical care sector.

Consider an excellent HUD multifamily loan might possibly be suitable for your property for the Idaho? Incorporate your details toward setting less than, and we’ll fits you for the greatest bank – and financing – for your financing means.

Multifamily Property Insurance policies in Idaho

Multifamily insurance costs enjoys shot from rooftop over the past long-time, since I understand you are aware. If or not you own (otherwise intend to very own) market-rate apartment strengthening or an easily affordable houses property, this can has a huge effect on their earnings – and you will, worst situation, power to operate whatsoever.

Janover Insurance rates Category is dedicated to locating the best insurance policies choices for the multifamily property within the Idaho, though it is sensible houses or if you are using good HUD loan. Simply click locate a free insurance offer to suit your property – no obligations at all.

Comment closed!