What we are going to protection

Looking you reside an important decision, both in person and you can financially, that have a lot at risk. It is typical feeling thrilled and you may stressed whenever you are drawing near to brand new prevent of your own mortgage processes. Make sure you’re available to the very last actions of the homebuying travels with our fast situations and greatest strategies.

Precisely what does closing with the a house suggest?

Anywhere between traveling house to discover the right place, securing financing, investing in a deal and you can settling inside with the swinging go out, the process of to shop for a house usually takes days. Closure is a few final strategies that are charge, inspections and more. Closure day is when the home, condominium otherwise townhouse legitimately and commercially becomes a.

Just how long involves closure to your property?

A routine closing procedure – from filling out the borrowed funds software to help you signing the new records to the closure day – will need ranging from four and you may six-weeks. Expect the day-from closure process to get between one to and two times since your signal paperwork and inquire their agent or lawyer people kept concerns.

Which are the steps of closure techniques?

Addressing the finish collection of their homebuying processes was smaller out of a race and https://www.speedycashloan.net/installment-loans-hi/ from a race. Based their buying products there may be most procedures, however, the majority of closings will include another:

A purchase arrangement is actually a binding agreement written right up because of the either a agent otherwise attorneys that lies out of the information on the transaction, that will tend to be:

dos. Loan origination

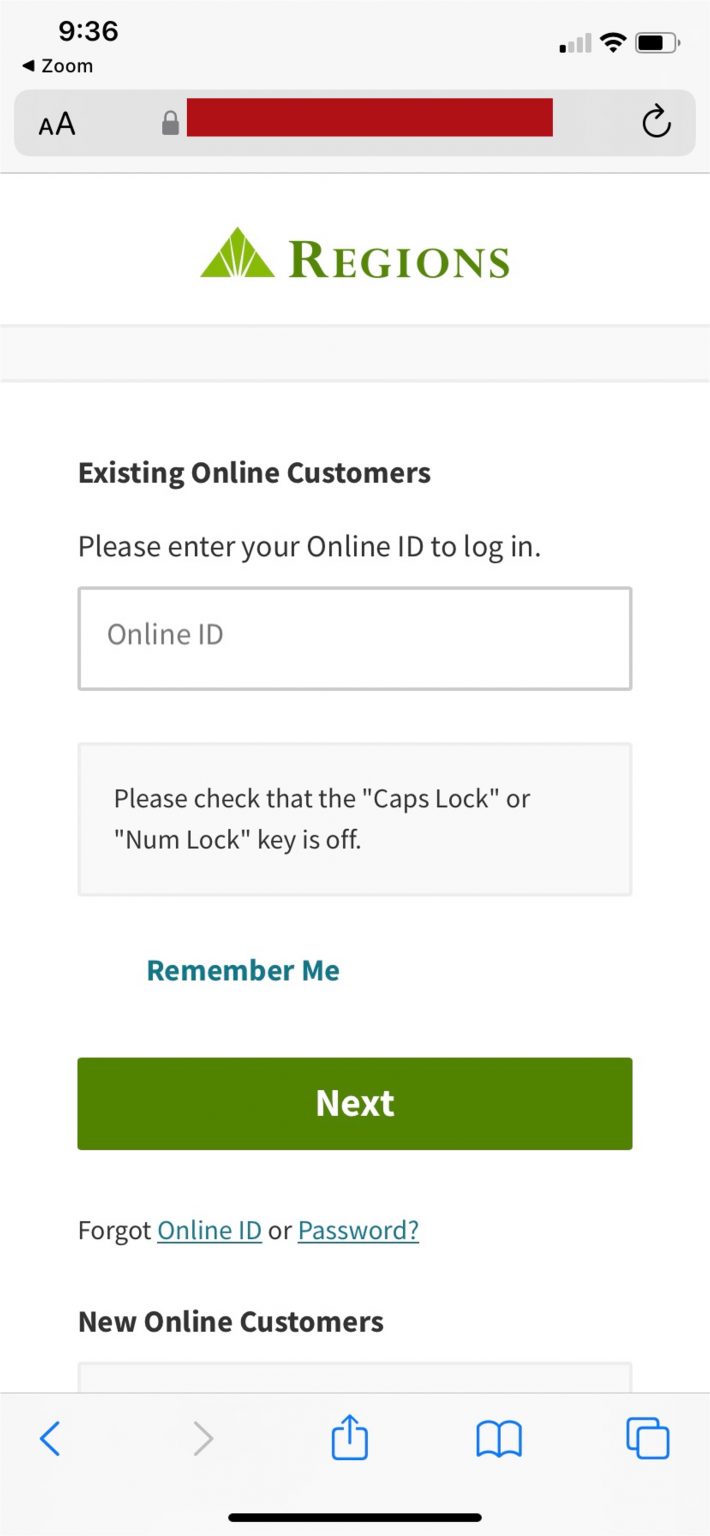

Origination refers to the processes the spot where the visitors was accredited and you will confirmed for a loan. You could consult a loan from a bank, focus on a home loan company otherwise score help from a national otherwise condition homebuyer program. You can first have to complete a mortgage app and gives evidence of income and you can property in addition to spend stubs, W-2s, financial statements, tax returns and you can funding comments. The lender will promote financing imagine for you to feedback and accept in advance of moving on on deal.

3. Residents and you will identity insurance rates

Into the assets purchases to endure, you will have to give proof of residents and you may identity insurance rates. Homeowners insurance covers domestic fixes in case there are ruin and you will is usually found in your own monthly mortgage repayment. Label insurance rates covers both you and your bank if there is any title factors.

cuatro. Home evaluation

You might want – or even in some cases be needed – in order to agenda a specialist home inspection done by an authorized. You really need to sit in when possible. Within examination, an experienced personal tend to assess the position off devices, tools, electricity, plumbing system, hvac, additional and more about home. New ensuing statement will be your guide when it comes down to established or potential products you’re going to have to address when you move in. When the points can be found, you will work on the seller to decide who will protection the expense to resolve all of them.

5. Closing disclosures

Shortly after all else try closed off, you will get a notice of your closure date, some time and area, in addition to a summary of what you should bring about closing go out (more about you to less than). You’ll also be given an ending disclosure by your lender and this has your final mortgage terms and conditions and you will closing costs.

6. Last walkthrough

A single day ahead of closure, your real estate professional tend to agenda a last walkthrough of one’s property to be sure the seller’s chairs and you can home have died. Bring this time to check on appliances, faucets, light fixtures, windows, doors, locks and you can anything you could think of – it’s your last chance to establish things are in the proper performing purchase in advance of sealing the deal. Show concerns and ask people kept concerns you’ve got; you don’t want to sign or purchase something you feel not knowing on the.

Comment closed!