Essentially, you ought not risk pull out one the fresh new debt while you are in the process of closing a mortgage loan. Therefore, when Are you willing to Score an unsecured loan Shortly after Purchasing a home?

Together with, once you have closed towards that loan, you probably need to wait three to six weeks prior to taking out a consumer loan. Unsecured loans they can be handy to own residents, and there is zero specialized code you can not make an application for one to if you find yourself interested in a house.

- Your credit score takes a hit and you will apply to your loan prices

- The debt-to-earnings ratio can get raise and you will affect your own mortgage qualifications

- When you’re currently working with a lending company, they are alerted on financing craft

- You may also perception your mortgage loan qualifications even though you’ve started eliminated to close off

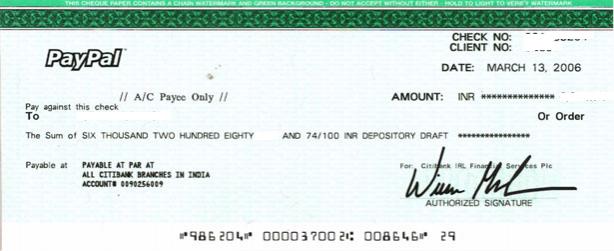

If you are however being unsure of out of if you will want to take-out good personal loan when selecting a property, let me reveal a keen infographic which can help you learn:

If you get a personal bank loan When selecting a home? Do’s and you can Don’ts

- Try to take out a consumer loan to pay for the brand new down payment.

- Intend to acquire to pay for settlement costs, inspections, moving costs, etcetera. that have a consumer loan.

- Pull out that loan at all if you intend to use to own home financing in the near future, as a whole.

- Attempt to cover-up consumer loan activity off loan providers.

- Have fun with a consumer loan to own expenses such as chairs, repairs, home improvements, and you may non-home loan expenses well after you have currently paid in your brand new home.

Expenditures associated directly to new product sales-such as for instance appraisals, monitors, and you will off costs-should be paid for having bucks otherwise from currency borrowed personally from the mortgage lender.

Note that it relates to more than simply unsecured loans online loans Strasburg CO. Also borrowing of friends can occasionally features unforeseen effects. Because the tend to, financial gurus comment debt activity observe how much time you have had your money. One abrupt highest grows may need to getting explained to the newest prospective mortgagor, which could harm your chances so you can be eligible for home financing.

Let! I got myself a house now I’m House Worst

Whether your mortgage repayments try taking on much more than the advised twenty five% of one’s grab-home pay, you could getting financially restricted, aka house worst.

This really is a tricky problem to deal with. Listed below are some ideas while facing a housing-relevant overall economy:

When in Doubt, Pose a question to your Financial Officer

Unsecured loans may come in accessible to property owners trying advancements otherwise solutions. Even so they can be tricky to make use of next to home-to acquire time.

Nevertheless, you can always inquire the broker you will be coping with if the taking away a personal loan is a good idea. Each mortgagor varies and most have to help you provides a successful homebuying sense, therefore it is generally best for trust its guidance.

All the information in this article is actually for standard informational aim simply. Republic Financing will not make any guarantees or representations of every type, share or created, with respect to the guidance given within this blog post, including the reliability, completeness, exercise, usefulness, supply, adequacy, or reliability of information inside blog post. All the info contained here is not meant to be and does not compensate monetary, legal, income tax and other guidance. Republic Loans has no liability for any mistakes, omissions, otherwise inaccuracies on advice otherwise one accountability due to any dependency apply such as for instance pointers on your part otherwise anyone who may getting told of your own suggestions in this post. People dependence you add on advice in this article is strictly at the individual chance. Republic Loans may site businesses inside article. A 3rd-group resource will not comprise sponsorship, affiliation, commitment, otherwise approval of that alternative party. People third-class trademarks referenced will be the possessions of its respective residents. Your play with and usage of this web site, website, and you may any Republic Loans site or mobile software program is at the mercy of our very own Terms of use, offered right here.

Comment closed!