There was money into your family. Not actually, however in the form of collateral. It can be used for pretty much some thing: renovations, debt consolidating, educational expenses or to shop for a vehicle. All you need certainly to loans, you might be capable of they along americash loans Cripple Creek with your home’s guarantee.

Our very own fund let you obtain a lump sum payment and spend it straight back more 5, ten, 15 otherwise twenty years. It’s good for financial support a massive investment such as for example a new kitchen area, an automible or some other big-citation product. There are many reasons discover a home guarantee mortgage away from us, plus reasonable, fixed prices and you will repayments that wont transform on the lifetime of the loan, no factors, zero appraisal charge without software costs. It is the best way of financing everything.

House Security Fixed-Rates Loan

Loan costs work well: *Apr indicates Apr. Prices are at the mercy of alter without warning. Costs trust analysis of candidate borrowing from the bank. Real cost may vary. step one All of the repayments quoted significantly more than are based upon $1,000 borrowed. To receive an estimated monthly payment to own a designated loan amount, proliferate the fresh payment per month factor for the wanted loan identity of the how many thousand cash lent. Determine the payment with this Finance calculator.

Family Security Credit line Pricing

Financing pricing work well: The current primary rate try 6.25%. *Apr denotes Annual percentage rate. Prices try susceptible to transform without warning. Cost are based upon assessment out-of candidate borrowing. Genuine pricing can differ. 1 New line of credit speed try at the mercy of change month-to-month. The rate is founded on the prime speed as the penned in the new Wall structure Path Record toward last business day of your few days and additionally an effective 0.0% Margin rounded doing the new nearby 0.25%. Minimal Apr is step three.99% therefore the limitation Apr is 18%.

Far more issues, significantly more features, more of what you want.

I have hitched with Visitors Home and you can Auto insurance. As a part, you could save your self typically 606* on your own auto insurance.

Life insurance can take advantage of a significant part in any propose to perform long-label monetary safeguards. And it simply feels very good to find out that your family would feel protected in the event that things happened to you.

Family Security Faq’s

To search for the equity available in your home, bring your house’s appraised worthy of otherwise income tax analysis and you will multiply they by the 80% (the loan to help you well worth proportion), and deduct people a fantastic liens.Such as for instance, let’s say you’ve had a home loan on the domestic out of $a hundred,100 getting 10 years and also have paid back the main to $sixty,one hundred thousand. In the ten years you have had your residence, assets values in your area have raised now your house will probably be worth $125,100. Within example, you will be capable acquire doing $forty,one hundred thousand using your domestic given that security for the financing.

This is computed the following: Appraised property value family: $125,000 Multiply by 80% (financing in order to really worth ratio): ($125,000 x .80) $one hundred,000 Shorter the rest of the very first home loan: $sixty,000 Equals: $40,100000 during the readily available equity

Home collateral financing are for sale to step 1 so you can cuatro members of the family domestic gadgets, which are owner occupied while the primary houses for the Pennsylvania and you may New Jersey. Assets insurance policy is necessary. Flooding insurance rates may be needed.

Property collateral line of credit is a varying-rate membership which allows to have frequent borrowing from the bank without having to re-implement anytime. A timeless household collateral financing offers a fixed matter of money repayable more a fixed time frame from the an effective fixed interest. Constantly, the brand new percentage plan requires equal payments which can pay off the whole mortgage contained in this the period. You can think a traditional family equity financing as opposed to a house guarantee line if the, particularly, you want a set matter to own a specific purpose, instance an improvement to your home.

Usually, a repeated requirement for funds implies the necessity for property collateral line of credit. A good example of this might be tuition money.

Money are on step 14-device loved ones, owner-filled houses inside the Pennsylvania and you will New jersey. Property insurance is required. Ton insurance may be needed. There are not any software fees with no items having household equity repaired price or line of credit money. Minimum amount borrowed from $5, necessary.

Create Some one Earliest Information

- Bank card Accessibility

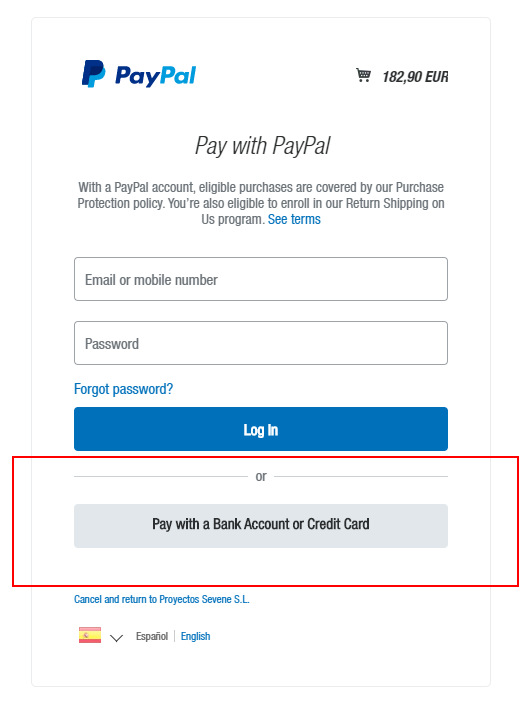

- eLoan Payment Portal

- Application for the loan

- Mortgage Accessibility

- Mortgage Application

- Applications & Variations

- Disclosures

- Professions

- F

Comment closed!