Whether your loan application is eligible. The DTI ratio can also affect the sum of money lenders are prepared to give you. If for example the DTI proportion is gloomier, it indicates you have sufficient income. To easily protection the new monthly obligations from a larger loan amount. not, in the event the DTI ratio are high, lenders could be concerned about your capability to deal with the additional debt burden. Therefore, it ount to make sure that the monthly obligations continue to be sensible and you may in check. Considering your financial obligations.

Rate of interest Considering

Their DTI proportion may determine the pace at which loan providers are prepared to offer a home loan. A lowered DTI ratio is often considered an indication of monetary stability minimizing borrowing risk. Lenders get award consumers that have all the way down DTI percentages by offering them much more competitive and you may affordable interest levels. Concurrently, a top DTI proportion can lead to loan providers seeing you as increased-risk debtor. To pay for this enhanced risk, they could charge you a top rate of interest on your home loan.

In a nutshell, your DTI proportion are a crucial component that lenders consider when assessing your property loan application. It will feeling your loan recognition potential, how much cash you could acquire, additionally the rate of interest you’ll end up provided. Keeping a diminished DTI proportion because of the dealing with the money you owe and you may growing your income makes it possible to secure a whole lot more favorable terms and conditions on your mortgage and you will improve your complete economic well-are.

Secret Challenges and Considerations for the DTI

- Compliance: Loan providers have to conform to regulatory guidelines and you can user shelter statutes when changing DTI formula approaches to end legal and you will economic outcomes.

- Study Ethics: Exact and you will consistent investigation collection is essential for active DTI ratio calculation. Loan providers must be certain that borrower income and you may debt obligations bank of Oklahoma personal loans to keep up computation stability.

- Transparency: Loan providers will be educate individuals regarding the DTI computation actions and how it connect with financing eligibility. Clear and you will transparent communication assists individuals see their bills.

- Exposure Government: Loan providers need to evaluate borrower chance thereby applying ways to mitigate potential losses out-of high DTI financing. This consists of means credit limits, setting up risk supplies, and overseeing debtor creditworthiness.

After you like Credit Dharma for your house loan demands, you unlock several advantages so you’re able to save money, get mortgage versatility quicker, and simply see all your valuable homes funds need.

- Competitive Mortgage Interest rates: Benefit from lower pricing doing during the 8.4% a-year, reducing your complete expenditures.

- Quick Mortgage Disbursement: Sense prompt mortgage processing, making certain you could potentially move on together with your family preparations in the place of a lot of waits.

- Lifelong Help: Take pleasure in lingering expert help of Credit Dharma’s devoted people at each stage of your home financing excursion.

- Spam-Totally free Experience: Be assured that their confidentiality is valued, and also you won’t receive undesirable correspondence.

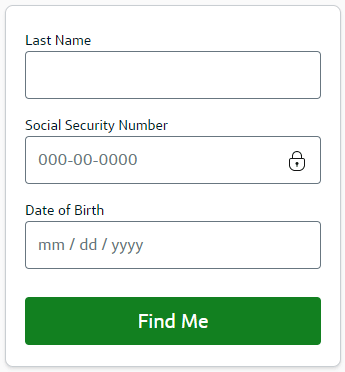

Providing a mortgage having Borrowing Dharma is simple. Merely bring the loan info, preferred assets number, and you can town; they will certainly let determine your property mortgage eligibility, streamlining your way so you can homeownership.

Borrowing Dharma brings personalized economic recommendations to greatly help contain the best home loan. The gurus show you with the improving qualifications for the most favorable mortgage conditions, offering a clear and you may hassle-free techniques.

Faq’s

Answer: When figuring DTI, points tend to be month-to-month personal debt repayments (credit cards, finance, alimony, etc.) and you may terrible month-to-month money (earnings, bonuses, rental income, an such like.), showing most of the earnings in advance of fees or deductions.

Answer: Your debt-to-income ratio (DTI) is a vital financial metric lenders used to assess good borrower’s ability to create monthly obligations and pay back debts. A lower life expectancy DTI ratio indicates that a debtor have a diminished number of personal debt on the earnings, that is essentially seen as beneficial of the lenders.

Comment closed!