Of many possible consumers are interested in possessions and want to see as much as possible get home financing in place of permanent a job. Property is one of the most preferred assets, if or not private explore or for financial support aim. Its lower in exposure and fairly anticipate an excellent assets which you purchased to get well worth a whole lot more next season.

Of many potential customers become builders during the a predetermined title or project foundation. Some are freelancers otherwise separate designers working in the newest gig savings. There’s a different processes to get a mortgage when self employed, that is different to working into a contract and that is generally offered. Right here we’re covering the situation where you are utilized by a family, yet not to your a low-long lasting basis.

There can be an extremely well-known view one to attain a home loan you ought to have a long-term employment. So it rationale is sensible because the home financing is typically having a long stage, constantly ranging from 20 and you can 3 decades. It can then make sense one having a long-term job form the likelihood of your to be able to spend a loan regarding enough time work better. But is it really?

Lenders and you will Long lasting against Package Work

Times are modifying. The use rate is quite high in South Africa and and businesses are hiring on a good contractual foundation and you will a lot fewer individuals rating hired to your a permanent base. At the same time, financial institutions have to continue steadily to profit. Might procedure from a lender is always to lend currency and earn profits regarding the focus. Which have faster and you may a lot fewer anyone are forever operating, credit formula have to slow switch to match around the a job landscape, otherwise banks goes bankrupt.

Are you willing to Rating A home loan As opposed to A long-term Job?

The quick response is yes, you can aquire a home loan instead of a permanent work. However, there’s something that you may need positioned before applying getting home financing http://simplycashadvance.net/loans/same-day-personal-loans/ versus a long-term employment. That have an excellent a career and you can borrowing profile often replace your odds of going mortgage.

When i planned to pick my personal very first property, Used to do a lot of lookup on if or not I wanted an excellent permanent business to locate a mortgage. I had all in all, five years really works sense, all of the below repaired name price. I never removed home financing in early stages just like the I read a lot of minutes that you should be forever employed to access home fund. Has just, when doing look with the matter, I came across nothing written down to verify it. So i simply made the applying to find out for myself.

Pre-Recognition

What caused me to create a mortgage software is the Nav >> Money function towards the FNB software. This new element explained all of the borrowing institution that we be considered to have and below home loan, they said that I actually do qualify for a mortgage. This is while i commonly nevertheless operating simply gig discount jobs.

Brand new green club having financial wasn’t because the full because it’s now but FNB performed render a reason to the just how to improve they from inside the application. I done improving they of the making certain that I didn’t spend all the cash I had in the times. I had regarding the one third of one’s money I gotten within the thirty days leftover in my membership at the conclusion of the latest day. The amount of time to improve it two in which it is (from all around 65% to around 85%) regarding above visualize try 4 days.

The newest FNB software now offers a solution to get pre-approved having a mortgage throughout the app so i applied having pre-acceptance in addition to next day I had a beneficial pre-acceptance email and you may a bond application form.

Immediately following reading through the application, I spotted that there try a field in which it asked about permanent employment. During those times, I thought i’d maybe not apply for a mortgage from the lender. I would personally save up for a deposit and implement through an excellent bond inventor after i got saved up the money.

Implementing Compliment of A bond Originator

Just after rescuing right up, I contacted a thread creator and took me as a consequence of the very own pre-acceptance procedure The reason behind using thanks to a thread originator is which i realize in lots of posts that thread originators are able to negotiate into the banking companies in your stead. For individuals who incorporate by yourself, you cannot discuss plus the result lays solely regarding how the app appears on paper.

The fresh new heartening most important factor of the application about bond founder would be the fact discover zero question regarding long lasting employment. Once getting pre-acknowledged, We generated a deal for the possessions I wanted to invest in additionally the home broker registered all the documentation in order to bond originator. Within weekly, I got a reply from the basic financial, saying that that they had acknowledged my application in principle.

Business And you can Credit status When i Taken out Home financing

Once i produced my financial app I was on the next times out-of a career having a that is I became with the a good 3-day package that i are sure might be renewed. I got recently been operating an online work to own annually prior to one to. I happened to be providing a couple of salaries once i used although loan amount that we is pre-accepted to have is maximum for what I could pay for during the your day business in which We produced a pay slip.

My credit score status is categorized since the very good, which is cuatro away from 5, otherwise one-step below the best possible get. Which stems primarily regarding that have got car funds for a couple of decades and not destroyed a cost towards the vehicle. Away from one, my personal just borrowing from the bank was a mobile-cellular telephone deal and you can a Telkom cellular phone line that we got had for several decades.

My personal credit rating was not pristine. The top point would be to not default for the products that required a card app. With gone through a bad plot 24 months earlier in the day, I had defaulted on some things along the way. If you manage read an emotional monetary period, this isn’t the termination of the world, you ought to simply strive within fixing your credit score.

Things that you should get home financing

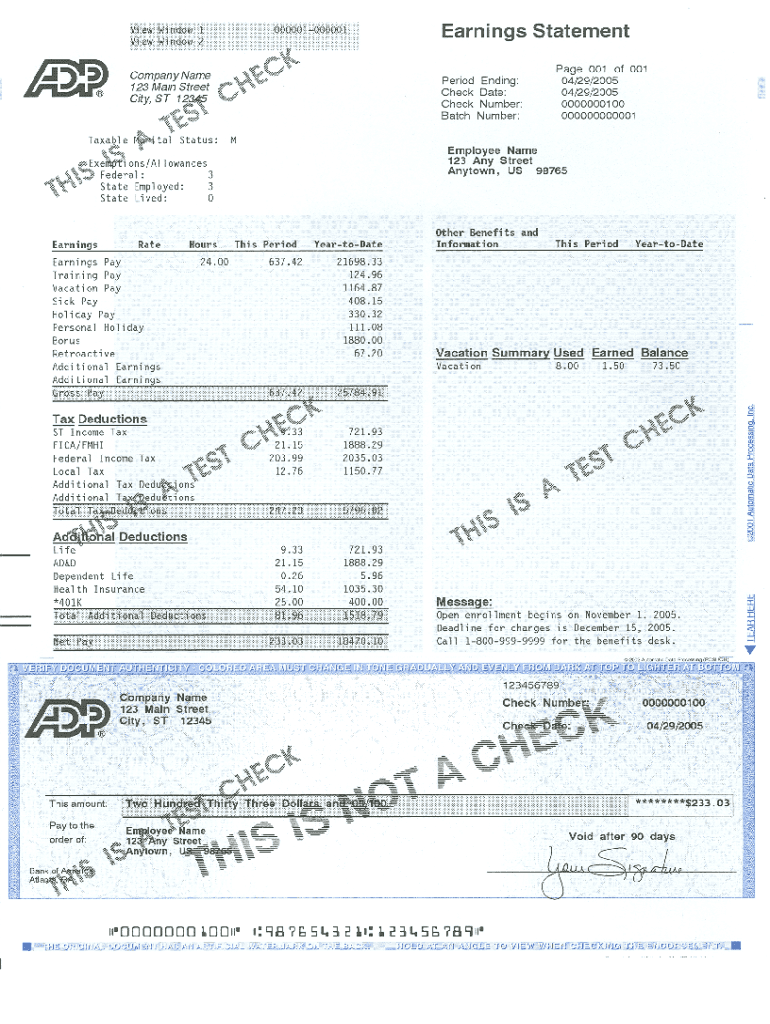

- Payslip

- A good credit score Number

- 3-six months bank comments

The fresh new payslip suggests that youre actually functioning. The three-six months lender comments verifies you are providing profit your account month-to-month and that you have enough money for repay good mortgage. Good credit shows that youre an established borrower and get a premier likelihood of investing your residence financing.

Completion

It’s not necessary to possess a permanent work to obtain a home loan. Brand new lenders’ priority are guarantee that you are in a position to cover your property financing. This is certainly demonstrated through an effective borrowing from the bank profile and an employment standing that shows that you’re receiving sufficient money per month to fund the home loan over a length longer than a year.

Comment closed!