The last 1 year have experienced numerous change and you will it drops to your united states as mortgage brokers to help you adapt to the fresh new the landscaping. We yes didn’t suppose that in some instances, industrial funds would be less expensive than residential money funds!

APRA is not attempting to make everything difficult

Given that you’re probably alert, all the banking companies make alter on their interest just plan and you may prices due to limits set up of the APRA. Just like the home loans, we definitely hate that have the choice limited, otherwise one additional difficulty so you’re able to choosing the right mortgage for a good client.

- Australian continent is addicted to notice only funds, it is a threat for both the banking companies and you can the housing markets.

- Couples consumers understand how much way more desire they will spend with an interest simply financing.

- There are various anybody while making attention just payments regardless of if it is completely unsuitable in their mind.

Great inquiries end in high pointers

At home Loan Professionals weuse a few easy questions to choose if desire merely money are suitable for a customer. Such, you might pose a question to your users in addition to this important to him or her:

- A lowered rate or lower costs?

- Higher borrowing power otherwise a diminished rates?

- Do you want to decrease your payments for a while?

If the a diminished rates or increased borrowing from the bank stamina is far more crucial that you a consumer, chances are they should really getting expenses P&I.

Manager filled finance having desire only payments

Typically, this really is an unacceptable selection for really clients and you should only think about this if there is a good reason to take action.

Such as for example, yourself Financing Positives we had believe notice simply for a house loan in case your buyer expected installment self-reliance the help of its business cash-move, or if perhaps they wished to remain their money for the standby during the an offset membership in case of issues, or if perhaps it planned to dedicate its too much fund.

If they are perhaps not economically excellent then it is unsafe. They might be impractical to benefit out-of desire only payments and possibly, they could perhaps not pay back their property financing anyway.

It’s time to communicate with non-conforming loan providers

At your home Loan Benefits, we imagine financing financing becoming a variety of low-conforming loan. That isn’t to state that banks try not to do her or him. They might be simply not brand new taste of the week and you need to consider professional loan providers in addition to major of these if you find yourself likely to meet the requirements of your house investor customers.

Precisely Orchid payday loans what do the brand new numbers state?

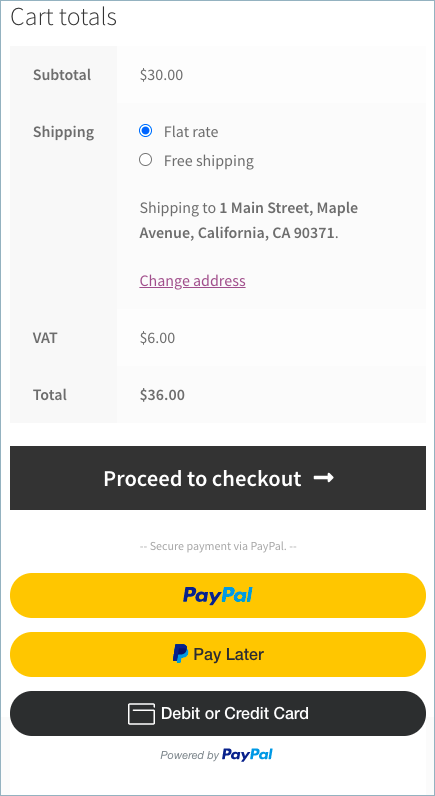

What if one of the users is actually deciding anywhere between a beneficial $five-hundred,000 resource mortgage during the 4.5% more 3 decades, otherwise financing during the 5% for 5 many years with desire only payments reverting to twenty five years at 4.5% with P&We costs.

To begin with new payments are $2,533 / week P&We as compared to $dos,083 / few days appeal only. Therefore the costs is actually 21% large when they spend P&I. At the conclusion of the attention merely months the newest repayments carry out feel $dos,779 that’s nine% greater than the standard P&We costs more thirty years. Couples clients are familiar with this plus a lot fewer look at the impression that this are certain to get on the bucks-circulate.

Paying P&We, the consumer would make complete costs away from $912,034 while, having a good 5 year interest simply period that they had shell out $958,749. That’s a whopping $46,715 in additional focus! Once again pair clients are conscious of how much a lot more they will cost him or her.

A great guideline is that a beneficial 5 seasons notice merely months costs a buyers eleven% far more in the attract along side title. That’s and if, definitely, which they aren’t getting other attract just several months whenever their very first that ends.

How about credit electricity? If just one debtor which have an income out-of $a hundred,000 takes out a mortgage, chances are they can use around $620,100 having P&I payments or $585,100000 having a great 5 season appeal simply several months. It is not an enormous contract, just a good 6% huge difference. Having consumers having multiple services, it does expect to have larger effect.

Think about your customers?

Should you refinance them to the most affordable focus simply financing available if they’re unhappy with regards to bank? Probably not. Adjustable costs would be changed any moment, so what’s to end new financial putting their pricing up?

It means it is time to shell out P&I. Correspond with these readers from the possibly using good P&I mortgage, refinancing to another financial which have P&I costs, or if perhaps they actually do want to shell out desire only, upcoming fixing its rates is generally sensible.

About Otto Dargan

Otto ‘s the Dealing with Manager out-of Mortgage Experts and has come a person in Connective for more than ten years. Financial Positives features claimed Biggest Broker of the year (Non-Franchise) and you will Otto provides double come entitled Australia’s Smartest Broker throughout the Adviser’s Representative IQ Race.

Comment closed!