- House cost features dipped from the level at the outset of 2024. Depending on the National Organization off Real estate professionals (NAR)’s Affordability Index Statement, the brand new value list has come down to 95.nine, level out-of 105.eight. Also you to definitely highest area are somewhat lower than 2021’s affordability index regarding 148.2. (Federal Relationship of Real estate agents)

- Only 19% away from consumers faith its currently a very good time to get a great house. That being said, it share shows an enthusiastic uptick out-of fourteen% in . (Fannie mae)

- Customer care with mortgage brokers is at a practically all-date higher. Centered on investigation of J.D. Electricity, total client satisfaction which have mortgage lenders was at 730 regarding 1000 inside 2023, upwards fourteen circumstances on the seasons early in the day. (J.D. Power)

Just how can Mortgage loans Really works?

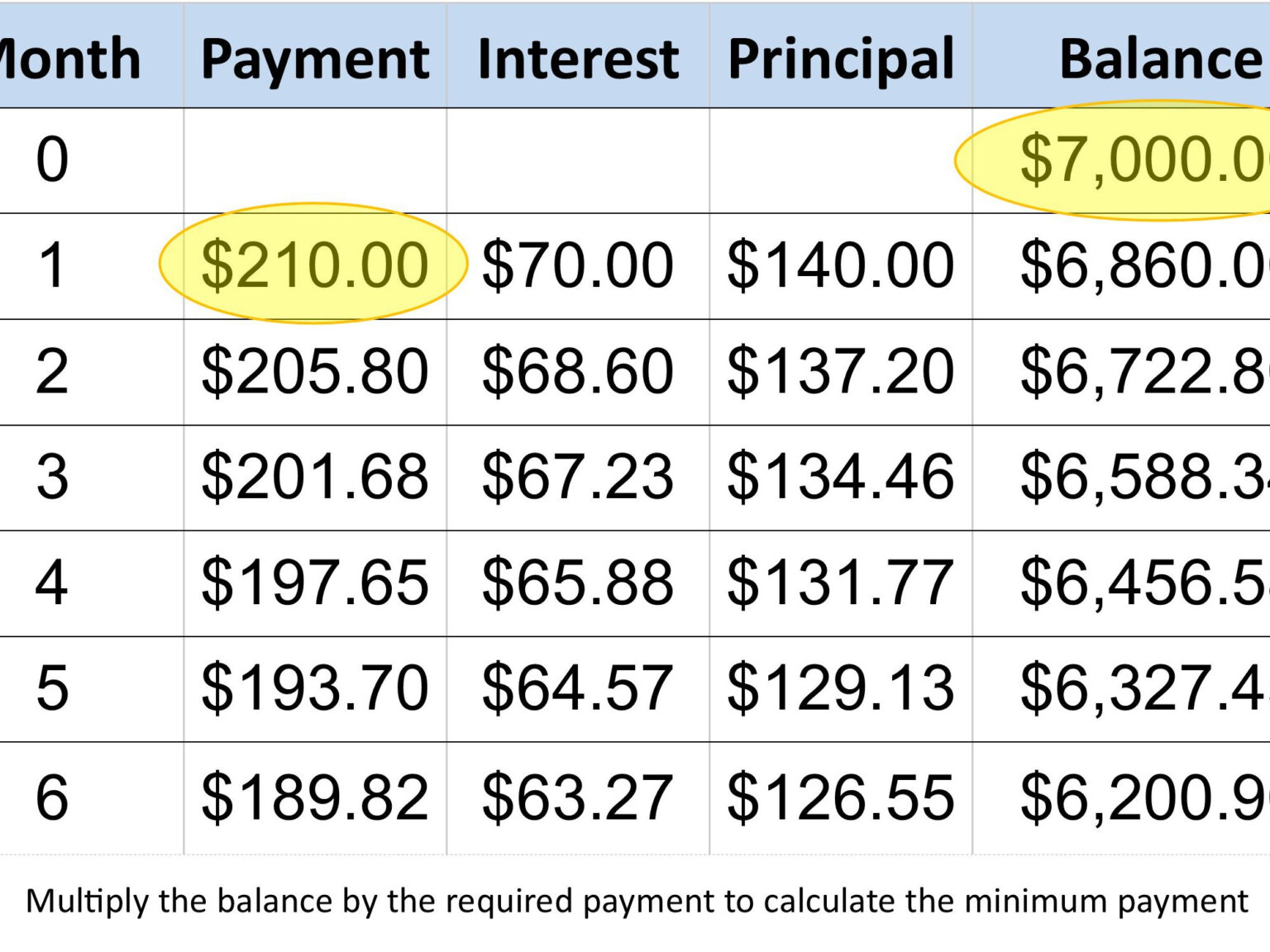

Per month, the initial amount regarding everything spend would go to any appeal that is accumulated because your past payment. Whatever’s remaining visits paying the loan equilibrium (just what mortgage lenders label dominating).

- When you have a fixed-rates financial, the quantity possible shell out every month to the dominant and you can attention never alter.

- When you have a changeable-speed financial (ARM), their payment can move up or down. It changes happens during the times laid out in your financing, constantly every six months or annually. If the percentage increases otherwise down hinges on this new list to which their home loan is tied. A lot of lenders make use of the Covered Immediately Funding Rates (SOFR), for example.

- When you yourself have a hybrid Case, their payment remains fixed toward very first element of their loan (always, 5 to help you eight many years). After that, it changes to an adjustable-price mortgage, with your rates adjustments future due to the fact revealed on the mortgage words.

Whichever type of home loan you’ve got, your property serves as collateral. This means that for people who avoid and come up with the home loan repayments to have sometime, the lender can also be grab our house.

Form of Mortgages

The best mortgage people usually provide a few different types of mortgages. So you can browse your alternatives, we are going to make you a quick overview of the best classes regarding home mortgage finance:

Conforming finance

On a yearly basis, this new Federal Property Money Agencies (FHFA) lies away a limit to own loan numbers. These types of will vary according snap the site to where you happen to live, with high-charged components taking higher ceilings. For the majority of the country, even in the event, new FHFA restrict getting 2024 are $766,550 for a single-family home.

Should you get a home loan this isn’t over your area’s FHFA limitation, it is called a compliant financing. Specific authorities-backed loans are conforming finance. Yet, if your loan does not have any government support, it is entitled a normal compliant financing.

Nonconforming funds

If you would like discuss the latest FHFA’s restrict or wanted to act else unconventional-including get an appeal-only loan-the financial is low-conforming. Home loan lenders fundamentally evaluate these loans highest-chance, very you’ll always shell out a lot more in the focus for people who go which channel.

Government-supported loans

Particular government organizations give to face behind loans. Whether your debtor closes paying the financial straight back, you to agency will help the lender recoup some of the costs. This setup lowers the chance to have mortgage enterprises, thus authorities-supported loans feature benefits such as for instance straight down rates and a lot more everyday borrowing conditions.

- Virtual assistant money. The Company off Pros Issues (VA) backs this type of financing to have effective-responsibility army personnel and veterans just who fulfill a minimum provider specifications. Virtual assistant loans don’t require any down-payment.

- FHA money. The fresh new Government Property Administration (FHA) supports these funds to simply help consumers just who you’ll or even end up being incapable of get investment. You might potentially be eligible for an FHA financing having a cards rating only five hundred when you can place 10% down.

Comment closed!