Mortgages, Process, Pricing, and Choice

To buy a property, even if fascinating, try a challenging monetary choice. Only a few features a mountain of cash to acquire a great household outright. Very residents trust mortgages.

Predicated on Analytics to have Mortgage loans 2023, 63% out-of residents in america has actually mortgages. Mortgage cost risen up to seven.76% to possess 29-year fixed-price mortgage loans and you will seven.03% getting 15-season repaired-price mortgages of the .

You will need to be aware that borrowing currency to have a property was a beneficial partnership you to extends more than several years. Hence, it is crucial to know the way it works to avoid worries subsequently.

Software

The first step should be to complete an interest rate application. This is when your commercially show the intent in order to borrow money to invest in a home.

- More information regarding the financial predicament, employment background, property, and you may costs.

- The loan app goes through underwriting an extensive assessment of one’s a position balance, money, or other financial items. Loan providers must make sure you feel the methods to pay off the newest loan.

- You happen to be expected to submit various data to prove your economic abilities, instance shell out stubs, tax returns, lender statements, and other relevant financial details.

Pre-approval

Which have a mortgage loan pre-approval, your rule to sellers and you may real estate agents that you are a significant and qualified client.

- It can help set a sensible budget for your house look, save time, and steer clear of frustration more property outside your financial visited.

- With gone through certain underwriting procedure during the pre-approval, the genuine mortgage processing may be expedited. That is eg useful in instances where an easy closure was wished.

Closure

They comes from your hard work and you may marks the state transition out of homebuyer so you’re able to homeowner. Some tips about what goes inside the closing phase:

- You are expected to create a down-payment. You only pay a portion of residence’s price upfront. The fresh downpayment dimensions can Tibbie loans differ but is will between 3% to 20% of your own home’s worthy of.

- It requires this new courtroom import regarding control regarding the provider so you’re able to your, and you theoretically end up being the home owner.

- You will confront a collection of documents that need their signature. These types of documents outline brand new terms and conditions of your own mortgage, the position because the a borrower, and other legalities of your own transaction. Read and you will discover for every single document before you sign.

Real estate loan Cost and you will Solutions

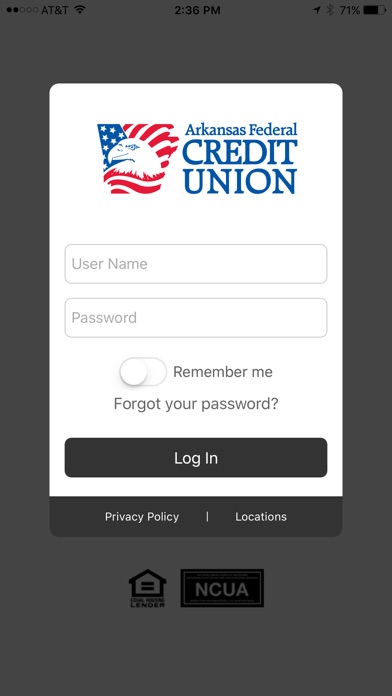

You can get a mortgage dependent on your alternatives out-of banking companies, credit unions (such Deeper Alliance), on line lenders, or mortgage brokers.

Imagine researching mortgage loan prices due to the fact littlest differences can significantly impact your general costs. These possibilities allow you to find a very good home loan with your homeownership aspirations.

Antique Financial

He’s supplied by a private lender otherwise financial institutions that consult a modest 3% down-payment however, need careful adherence so you can rigid personal debt-to-earnings rates. While they promote flexibility, conference such conditions is vital to have qualifications.

Fixed-price Mortgage (Predictability)

The rate of interest remains ongoing in the loan name of fifteen so you can three decades. There clearly was a sense of monetary safety no shocks, and you’ll usually know very well what to anticipate each month. Inside New jersey, the interest cost for fixed mortgage loans is actually 7.31% (30-year) and you can 6.74% (15-year).

Adjustable-Rate Home loan (Flexibility)

Possession enjoys interest levels that change considering sector conditions. Suitable for quick-title deals when the initial costs is straight down however, be equipped for activity.

Government-recognized Financing

It reveals gates so you’re able to homeownership for these having lower credit ratings or less down money. These types of mortgages bring a great deal more easy borrowing standards and reduce down payment options. Various kinds regulators-backed fund is actually:

Government Housing Administration (FHA Home loan): Also provides a more obtainable step 3.5% deposit and you can lenient obligations-to-earnings ratios perfect for basic-go out consumers and people on a tight budget or down credit ratings.

Pros Things Mortgages: Private in order to experts, guaranteed because of the You.S. Department from Experts Issues, Va fund award armed forces service which have positive conditions, including an alternate 0% deposit chance of rural portion. However, a funding payment at the closing are step one.25% to three.3%.

USDA Mortgages: Available for outlying way of life, USDA (You.S. Agencies regarding Agriculture) fund render good 0% deposit and no credit rating option to give homeownership within the shorter inhabited parts. But they do have secured charge.

Jumbo Fund

Its one of many nonconforming mortgage loans having higher-end a property. Jumbo funds money an amount surpassing the product quality constraints of the Federal Houses Funds Department, set at $766,550 to have much of the fresh new You.S. into the 2024. They often times require an effective credit rating out of 680 or more and you can a down-payment out of 10% to 15% or more.

Finally Terms and conditions

To order a property is essential, therefore ensure you are on the right path to help you purchasing one to which have appropriate mortgages. Capture a step closer to your dream house or apartment with Deeper Alliance Government Borrowing from the bank Connection. Contact us now!

Comment closed!